From August 1, 2025, ICICI has added new policies to its savings accounts, and the minimum monthly balance is now ₹15,000 for tier 1 cities and ranges from ₹2,500 to ₹ 7,500 for suburban and rural areas.

If you open a new savings account after this date, ICICI provides a welcome kit that includes a personalised cheque book of 25 leaves for free.

Beyond this starter kit, ICICI now also adds new online methods to request additional cheque books for you. You will find new leaf charges, limits, and delivery timelines in 2026.

In case you don’t get a free cheque book with your welcome kit, you can use this method to request it-

How Does Chequebook Request Through SMS Work in ICICI?

Now you can simply generate your request without the need for mobile internet; however, it is limited, and you cannot change the address in it. By default, it dispatches the cheque book to your registered address. Here are the steps –

- You must have an active SMS pack, and it only works on an account-linked mobile number.

- Open your phone’s SMS app and type ICBR (give space) Last 6 digits of your Account Number.

- On the “To” section, enter the number “5676766” and tap on the Send Button.

- You will get a confirmation Text SMS on your phone and Email with the service request number.

Order via WhatsApp Banking

In 2026, you can use direct chat banking to apply it. Follow these steps –

- Save +91 86400 86400 on your phone. (currently active)

- First send Hi to start the chat banking.

- If you are using first time, you may get a 6-digit OTP to verify your account.

- After Hi, you will get a reply with the Menu and all services.

- Select all services and tap on Bank account-related services.

- Tap on Request New Chequebook.

- Confirm with OTP and submit.

- Done.

In case these methods won’t work for you or you want a new address for delivery, you can choose this –

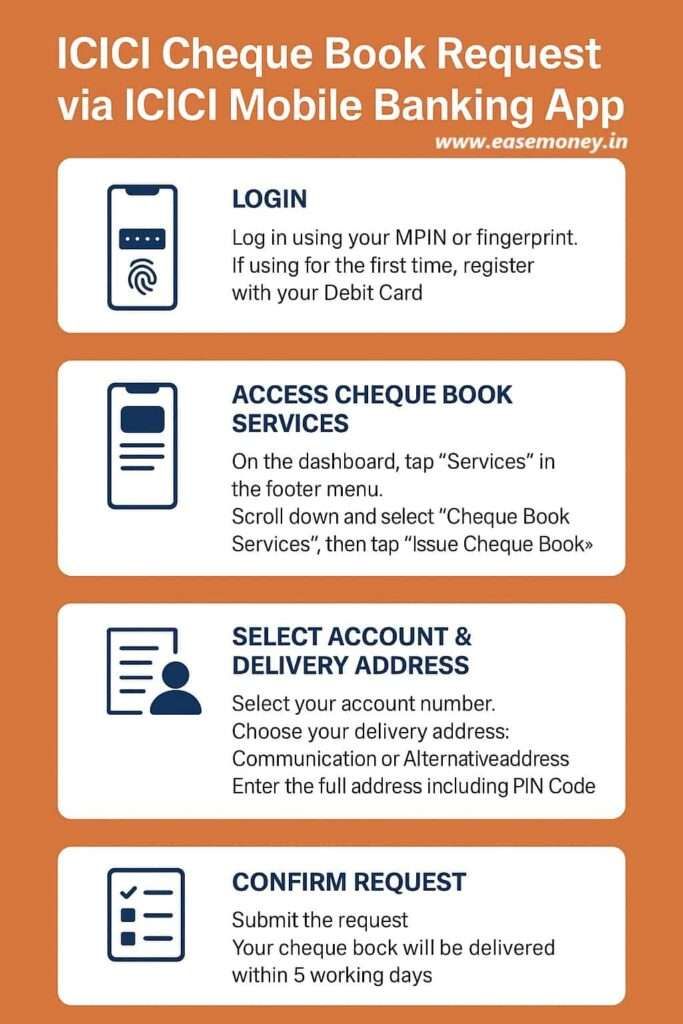

How to Get through the iMobile Pay App

ICICI’s iMobile Pay is the most versatile option for cheque book-related queries. You can use it to manage your cheque leaves as well. –

- First need to log in. Simply, enter your 4-digit MPIN or fingerprint.

- On the dashboard, tap Services at the bottom-right footer menu.

- Scroll down and find Cheque Book Services.

- Tap on the Issue cheque book.

- Now, you have to select your account number.

- Also, choose your delivery address –

- Communication Address (it’s your bank-registered address, where it automatically delivers)

- Alternative Address (You can add a temporary address for the cheque book only, no proof required)

- Select any address you want, home/office as an alternative.

- Tap on confirm, and you will get an order successful notification on your app.

Note: In most cases, the app may ask for your debit card’s back numbers and characters for verification.

What are the Delivery Timelines and Tracking

As per the ICICI official website, the estimated delivery time is specified as 9 working days after the ordering date of your new cheque book. However, it always depends on your location and the courier partner of the bank; in most cities, ICICI Choose the Bluedart company. Here are a few calculations as per the clients of the bank –

- Metro or Tier 1 cities: If you live in cities such as Mumbai, Delhi, your delivery must be within 3-6 working days.

- Sub-urban/rural areas: 7–9 working days. (such as Rewari, Dehradun, Ludhiana)

- High-demand periods (festive seasons): It may extend up to 10 working days.

How to track your delivery

- You can use the ICICI iMobile App. Simply visit services and tap on “Track My Account Deliverables”.

- To track, you can call the ICICI helpline 1800 1080 and give your SR number to get the real-time delivery date.

- Within 3-5 days, you are given an AWS number via SMS

- You can visit the tracking company’s site and enter AWS to track via courier.

What are the ICICI Cheque Book Charges and Limits

ICICI Bank applies transparent rules for cheque book issuance:

- Free leaves: First 25 cheque leaves per financial year are free. It works on all regular, digital and savings accounts of ICICI.

- Extra leaves: After the first chequebook, you have to pay ₹4 per cheque leaf, which calculates as ₹100 + GST for 25 leaves.

- Instant cheque book (at the branch): Around ₹125 + GST for 5 leaves.

- Personalised cheque books: Delivered with your name printed; no extra cost beyond per-leaf charges.

- Limit on orders: While you can request multiple cheque books each month, ICICI may hold back the issuance of new ones if you already have too many unused leaves. Also, it mostly depends on your account type.

Emergency Option: Get a Cheque Book immediately

Visiting an ICICI branch is a direct and last resort for you, especially when urgent needs arise. You can visit the branch and generate an order for a cheque book. The branch has two options –

- Standard request – The process is simple; you have to fill out a customer request form for issuing a 25-leaf cheque book for you and submit it to the help desk. It takes the same standard delivery timing.

- Instant cheque book- It is only for emergencies.

- Provide your original ID proof (PAN, Aadhaar, Passport).

- Request an instant cheque book at the counter.

- Issued within 10–15 minutes, typically with 5 leaves.

- These leaves may not have your name printed, unlike regular cheque books.

- Charges are not the same, read above.

Where can I download the ICICI customer request form PDF for a cheque book?

You can download the PDF from ICICI’s official website under “Forms Centre”, or you can ask for a printed copy directly from any branch.

What is the process for a chequebook for current account holders in ICICI?

If you have a business or current account, you have to download the InstaBiz app to generate a chequebook. Unlike regular customers, you can also choose how many leaves you want.

Is ICICI Bank providing a free cheque book with new savings accounts?

Yes. ICICI Bank provides a free personalised cheque book of 25 leaves as part of the welcome kit for most new savings accounts.

What is the SMS format to request an ICICI cheque book?

Type ICBR followed by the last six digits of your account number and send it to 5676766 from your registered mobile number with an active SMS plan.

How long does ICICI Bank take to deliver a cheque book?

Cheque books are usually delivered within 3–9 working days. Delivery time depends on location, courier partner, and demand during festive or peak periods.

What are the ICICI Bank cheque book charges in 2026?

The first 25 cheque leaves per financial year are free. After that, ICICI charges ₹4 per leaf, plus GST, for additional cheque books.

Can I get an ICICI cheque book instantly from the branch?

Yes, in emergencies. Branches may issue an instant cheque book with limited leaves within minutes, usually without name printing and with higher charges.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.