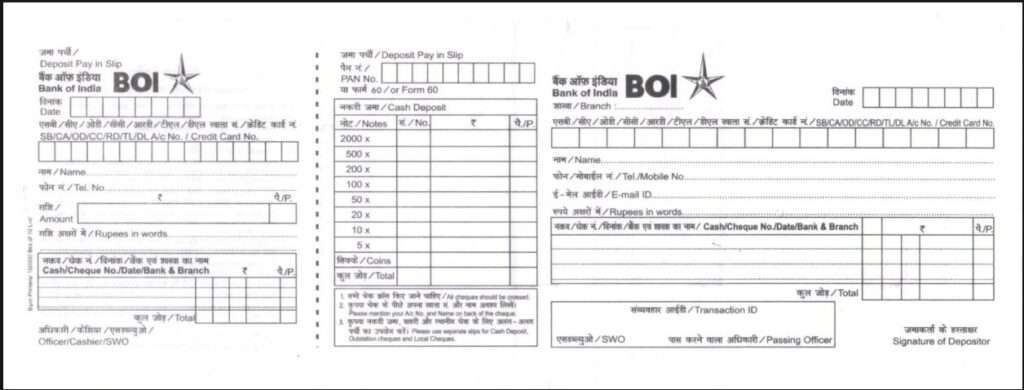

The rules of the BOI Deposit Slip are unique because the form is bilingual, varies by branch location, and is designed to record the full transaction trail for both cash and cheque deposits. In metro cities, Bank of India (BOI) branches often provide English-only slips, while semi-urban and rural branches may use Hindi-only or dual-language versions. Every BOI deposit slip contains two sides:

- Bank Copy – where the cash denomination table, cheque details table, PAN section, and teller verification space appear.

- Customer Copy – a simplified replica where account number, mode of deposit, and amount details are repeated for proof.

The deposit slip rules ensure correct posting, compliance with RBI guidelines, and prevention of wrong account credit. Below are the top rules followed across all BOI branches.

Top 5 Real Rules for BOI Deposit Slip Usage (Branch Deposits)

1. Deposit Slip is Mandatory for All Manual Deposits

Whether it is cash, cheque, or self-cheque, BOI does not accept manual deposit at a branch without a filled pay-in-slip.

2. Full Account Identification Must Match KYC

Name, account number, and signature must match BOI records to ensure the deposit is correctly linked.

3. Denominations Are Mandatory for Cash Deposits

Every note quantity (₹500, ₹200, ₹100, etc.) must be written to avoid a mismatch and to support teller counting.

4. PAN Requirement Above ₹50,000

For any cash deposit of ₹50,000 or more, PAN must be written on the slip, OR the depositor must update PAN in the account.

5. One Slip = One Transaction

Separate slips are required for:

- Cash deposit

- Cheque deposit

- Multiple cheques (each group requires slip + list, depending on volume)

Where to Find the Official BOI Deposit Slip

BOI offers its standard deposit slip in bilingual format through its official website. Metro branches may offer English-only versions, but the format remains structurally identical.

Official Method (BOI Website Path)

- First of all, visit https://bankofindia.bank.in

- Scroll to Footer Section

- Under Other Links, tap the Downloads button

- Open Other Forms

- Download Deposit Pay-in-Slip (English/Hindi)

Recently, the shifting of the all indian bank domain to bank.in, as per the RBI, you may find a temporary pause for downloading PDF forms, including Deposit or withdrawal.

Alternative Ways to Get the BOI Deposit Slip

| Method | Description |

|---|---|

| BOI Deposit Form (Original English or Hindi PDF) | Original PDF of the deposit slip |

| Visit BOI Branch | Counter staff will provide slips free of cost |

| Internet Printables | Format must match official BOI structure (recommended only from trusted sites) |

| Request Multiple Slips | Branches allow taking 5–10 slips at once for repeated use |

| ATM/CDM Lobbies | Some locations keep slips near the cheque drop boxes |

Tip: BOI branches never deny deposit slips; you can always request additional copies for home use.

BOI Cash & Cheque Deposit Limits (2026)

a) Cash Deposit

- First 5 cash deposits per month → Free

- 6th deposit onward → ₹50 per deposit

- Above ₹1,00,000 in a day → ₹1 per ₹1,000 (min ₹100 → max ₹10,000)

- Annual ₹10 lakh+ cash deposits are reported to the Income Tax Dept.

2) Cheque Deposit

- No fee for cheque deposit

- Separate slip required

- Cheques must be endorsed (signature + account number on back)

- One slip for each cheque set

- CTS grid clearing enables faster processing

How to Fill the BOI Deposit Slip (Cash)

You can use a blue or black pen to fill up the form, use Capital words such as ABC, and if you are filling out for cash, simply ignore the cheque filling box, and use the denomination table and count your notes, even coins.

BOI Deposit Slip – Field-by-Field Guide

| Field on Slip | What to Write | Example |

|---|---|---|

| Date | Deposit date | 19/11/2026 |

| Account Type | SB/CA (current account)/OD/CC/RD/TL | SB for salary or savings account |

| Account Number | Your BOI 12 to 17 A/c number | 545345341253 |

| Name | As per bank records | Nanne Parmar |

| Mobile Number | Valid phone no. | 9876543210 |

| PAN/Form 60 | Required above ₹50,000 | ABCDE1234F |

| Deposit Type | Cash / Cheque | Cash |

| Amount in Figures | Exact amount | ₹12,500 |

| Amount in Words | Full words | Twelve Thousand Five Hundred Only |

| Denominations | Count note-wise | See the table below |

| Cheque Details | Cheque no., bank, branch | For cheque deposit |

| Signature | Depositor’s signature | As per bank records |

Example BOI Cash Denomination Table

| Note | Count | Total |

|---|---|---|

| ₹500 | 20 | ₹10,000 |

| ₹200 | 5 | ₹1,000 |

| ₹100 | 5 | ₹500 |

| Total | — | ₹11,500 |

Tip: Always match the total with “Amount in Figures” to avoid teller objections.

Done, your bank copy side is completely ready to go, just repeat the same information to the customer copy and use the single cash or cheque box for filling the total amount, do your signature and done.

How to Deposit a Cheque at the BOI Branch

BOI’s cheque deposit process is straightforward and follows the CTS clearing system.

1. Endorse the Cheque

Write on the back:

- Signature

- Account Number

- Mobile Number

2. Fill the Cheque Deposit Slip

Include:

- Cheque number

- Bank name

- Branch

- Date

- Amount

3. Attach Slip + Cheque

Use a staple or paperclip.

4. Submit

Choose one:

- Branch Counter (recommended for acknowledgement)

- Cheque Drop Box (it may take some time to deposit into your account)

5. Collect Acknowledgement

The teller stamps your customer copy.

How Long Does BOI Take to Clear a Cheque?

- BOI uses the new continuous clearing window from 10 a.m. to 4 p.m.

- Cheques are scanned the moment you submit them at the branch.

- In Phase 1, banks get time till 7 p.m. to respond to the cheque.

- In Phase 2, the response must arrive within three hours of scanning.

- If the drawee bank stays silent, the cheque moves ahead automatically.

- BOI credits the amount within one hour after final approval.

- Most customers see the funds reflect the same day, often within 3–4 hours.

BOI Cheque Clearing Speed

| Phase | Deposit Window | Response Time Allowed | BOI Credit After Approval | Typical Customer Timeline |

|---|---|---|---|---|

| Phase 1 (Till Jan 2, 2026) | 10 a.m.–4 p.m. | Till 7 p.m. | Within 1 hour | Evening same day |

| Phase 2 (From Jan 3, 2026) | 10 a.m.–4 p.m. | 3 hours | Within 1 hour | 3–4 hours after deposit |

FAQs

Does BOI charge extra for non-home branch deposits?

No. BOI’s rules treat all branches equally under CBS. Free limits, PAN rules, and large-deposit charges stay identical whether you deposit at a home branch or another city.

Can I print a BOI deposit slip and use it legally?

Yes, if the format matches the official BOI structure. Many branches accept clean printouts, but messy or altered copies are rejected. Best option: download from BOI’s official site.

Is a BOI self-cheque accepted for depositing money?

Self-cheques are for withdrawing your own funds, not depositing. For deposits, BOI strictly requires a filled pay-in slip even if the money belongs to the same account holder.

Can I use the same BOI slip for cash and a cheque together?

No. BOI requires separate slips. Cash and cheque workflows follow different verification paths, so combining them delays posting and may cause teller rejection during peak hours. However, you can use multiple cheques for a single deposit slip.

Can I submit a BOI deposit slip without writing my mobile number?

Yes. Mobile number is optional. But adding it helps receive SMS alerts for cheque scanning or cash confirmation, especially useful if there’s a delay or posting mismatch later.

Do BOI branches accept deposit slips filled in Hindi only?

Yes. Hindi-only slips are fully valid across BOI branches. Metro branches may prefer English for speed, but Hindi slips are processed normally if the account number and amount are clear.

Is there a best time to deposit cheques at BOI for faster credit?

Yes. Deposit between 10:30 AM and 2 PM. Cheques scanned early usually clear faster under CTS, often reflecting within 3–4 hours on working days.

Can I club multiple cheques in one BOI deposit slip?

Yes, multiple cheques can go on one slip if space allows. Write each cheque clearly. For more than 3–4 cheques, branches may ask for an attachment list.

Does BOI allow handwritten corrections on the deposit slip?

Minor overwriting is tolerated, but corrections near amount or account number often lead to rejection. Best practice: take a fresh slip—branches give unlimited copies free.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.