How Cash Withdrawal Works with Slips in Canara Bank

In Canara Bank, a withdrawal slip works as a written order that allows customers like you to collect cash directly from their savings or current account. Different from a cheque that can be used in any branch, withdrawal slips are primarily accepted at the home branch where you opened your savings, current, or junior account.

You have to fill in the receipt with account details and submit it to the cash counter. The teller verifies your request before disbursing the banknotes.

Why is a Withdrawal form required?

- Provide proof of withdrawal for both the bank and the customer. It is mandatory for banking records, both digital and offline.

- Works as an alternative when you don’t have your cheque book and debit card handy.

- Useful for smaller amounts or for minors/junior account holders who may not have cheque facilities.

- It is especially used in villages, towns, and tier 3 cities if ATM card delays occur.

Where to Start the Process

The process starts by obtaining a withdrawal slip from the branch counter. You have to visit your base branch; there is no other option available to get an official slip.

These slips are free and available at designated stands inside the bank. You have to fill details carefully, as mistakes can delay your transaction, or rewrite another slip.

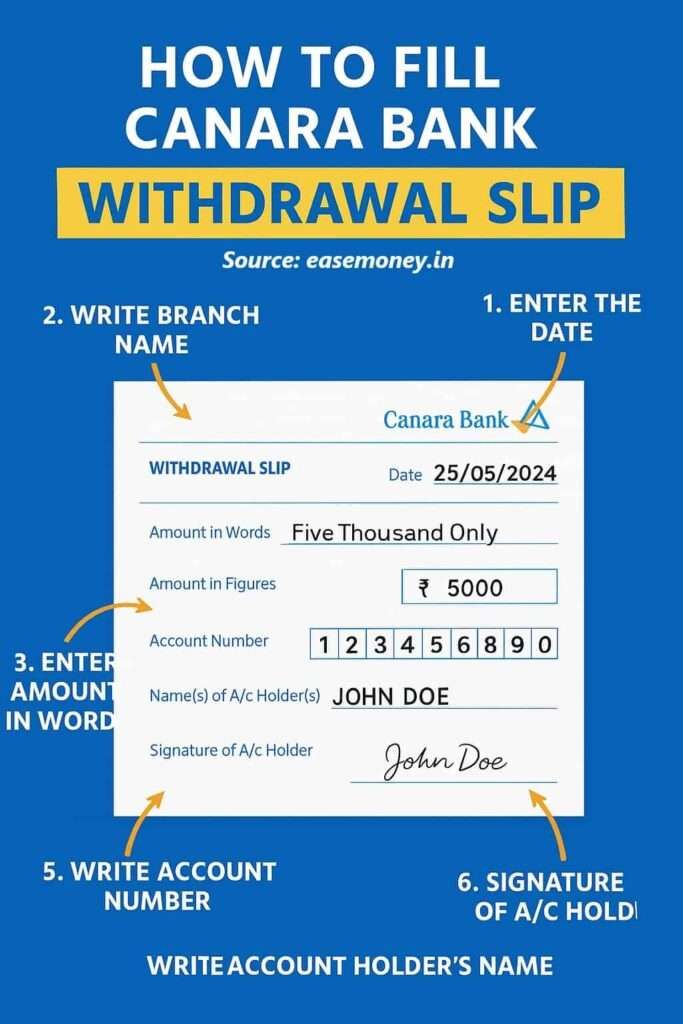

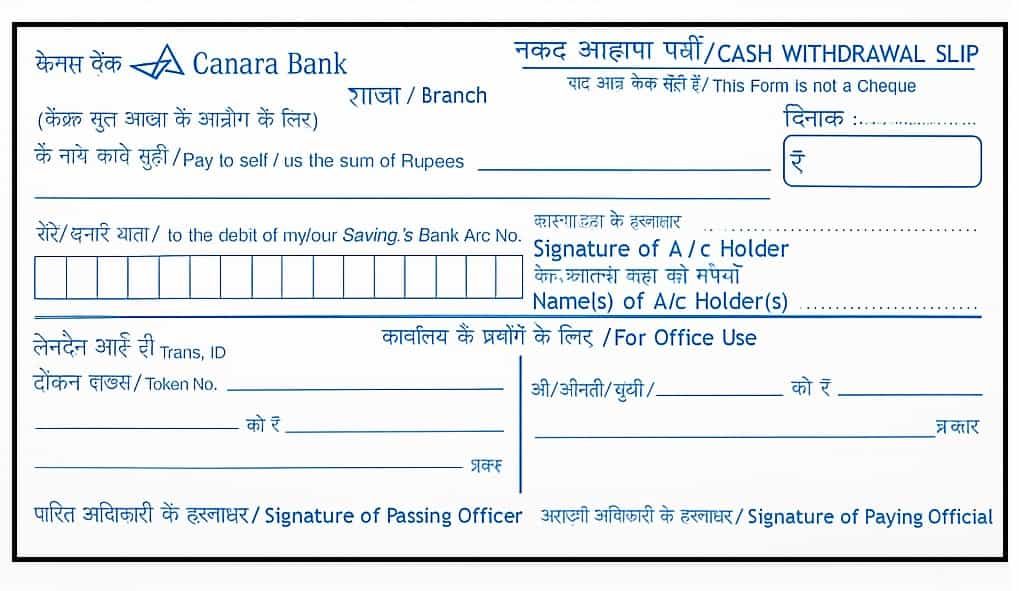

Step-by-Step Process to Fill a Canara Bank Withdrawal Slip

Here is a duplicate PDF image of the withdrawal slip. It’s good for practice, let’s learn step by step about filling.

- Starts with Date – Firstly, on the right side, put down the current date when you visit the branch.

- Branch Name – On the Opposite side, fill out your local branch name.

- Amount in Words – In the Pay to self section, write down the amount in clear words (such as – Five Thousand Only).

- Amount in Digits – On the right side, enter the same amount in the rectangle box with the ₹ symbol. Simply put – Rs. 5000/-.

- Account Number – In these 16 boxes, fill in your complete account number digit by digit. Here, your amount will be converted into cash.

- Name of A/C Holder – Write your full name as per the passbook or aadhaar card.

- Signature – unlike other banks, there is a major part, you have to sign 2 times.

- Front side – Sign in the space given.

- Back side – Mention the branch name again and put your signature below the blank space.

- That’s all, the other filling is now handled by the cashier staff. You can ignore the cash denomination table.

What Documents Are Required?

- Passbook – You have to attach your passbook to the cash counter. It is mandatory in most branches.

- ID proof such as Aadhaar, PAN, or any OVD (Officially Valid Document) if demanded.

- Your PAN card is mandatory if the withdrawal is above ₹50,000, or use a cheque book.

The Rules for Minor / Junior Accounts in Canara Bank

- Guardian-operated minor account – your Guardian must accompany and sign if you want to withdraw through the bank branch. alternately, use your ATM card.

- Self-operated minor account (usually 10+ years old) – Minor can fill a slip and withdraw independently.

- Withdrawal limit – For junior account holders, you can only cash out upto ₹5,000 per day as per RBI withdrawal norms (includes both ATM + branch withdrawal).

Cash Withdrawal Limits Using a Slip

| Account Type / Condition | Limit |

|---|---|

| Minimum withdrawal limit | Upto ₹100 via slips |

| Maximum limit for Normal account (home branch) | Up to ₹1,00,000 (branch manager’s choice) |

| Large withdrawals | The bank usually recommends using a cheque |

| Other branch (self-cheque) | Up to ₹50,000 |

| PMJDY / BSBDA / Small account (any branch) | ₹5,000 per occasion |

| Conditions | The real limit usually depends on branch availability and account eligibility |

What Are the Key Rules for Withdrawing Cash from Canara Bank?

- Valid only at the home branch for savings account ( PMJDY/BSBDA/small accounts).

- Withdrawal slip is not transferable; relatives or friends cannot use it.

- For third-party withdrawal, only a cheque is valid.

- A slip without a non-match sign or without a double sign is automatically invalid. However, people above the age of 70 can register their thumb as proof.

When to Use Cheques Instead of Slips?

- If you want to withdraw from another city or area branch.

- For amounts above ₹50,000.

- For third-party withdrawals (if you are withdrawing for your family, friends, and relatives).

- For amounts higher than ₹1,00,000 in most branches.

Does Canara Bank charge for issuing withdrawal slips?

Yes. If you already have a cheque book, issuing withdrawal slips incurs a charge of ₹4 + govt-approved current tax slab GST per slip for selected account types. However, for accounts without cheque books, slips are usually provided free of cost. You have to confirm with the branch first.

Unique FAQs

How can I download a Canara Bank withdrawal slip in PDF format?

As per the official website of Canara Bank, there is no official PDF available as such; however, you can use some third-party financial sites that provide ready-to-print slip templates for demo. It does not work at branches or any kind.

Is there any withdrawal slip charge for PMJDY or small accounts?

On PMJDY accounts, there are no additional charges for slips; the slips count as a free basic banking service; however, charges start if you exceed the 4 free withdrawal limits per account.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.