Your deposit Slip is like a ticket to deposit banknotes or a cheque into your account at any branch of SBI Bank. It’s not just a simple paper for formality; it is required for proof of your transactions or deposits you made.

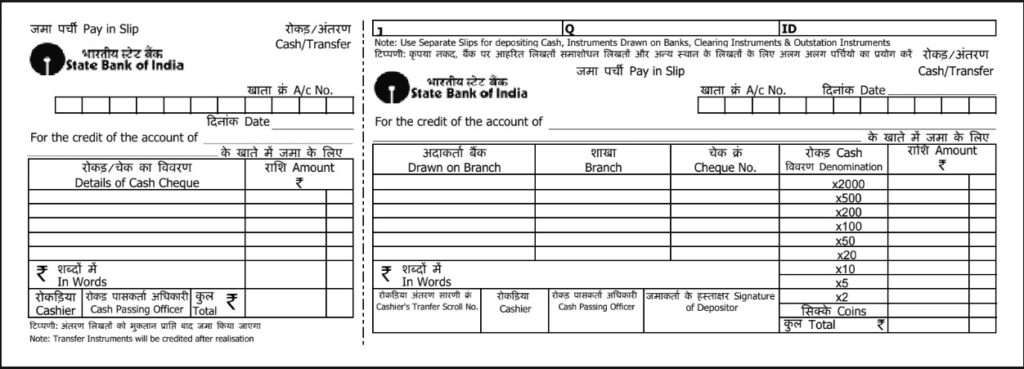

SBI has designed one slip for both cash deposits and cheque deposits, so you don’t need to hunt for different forms.

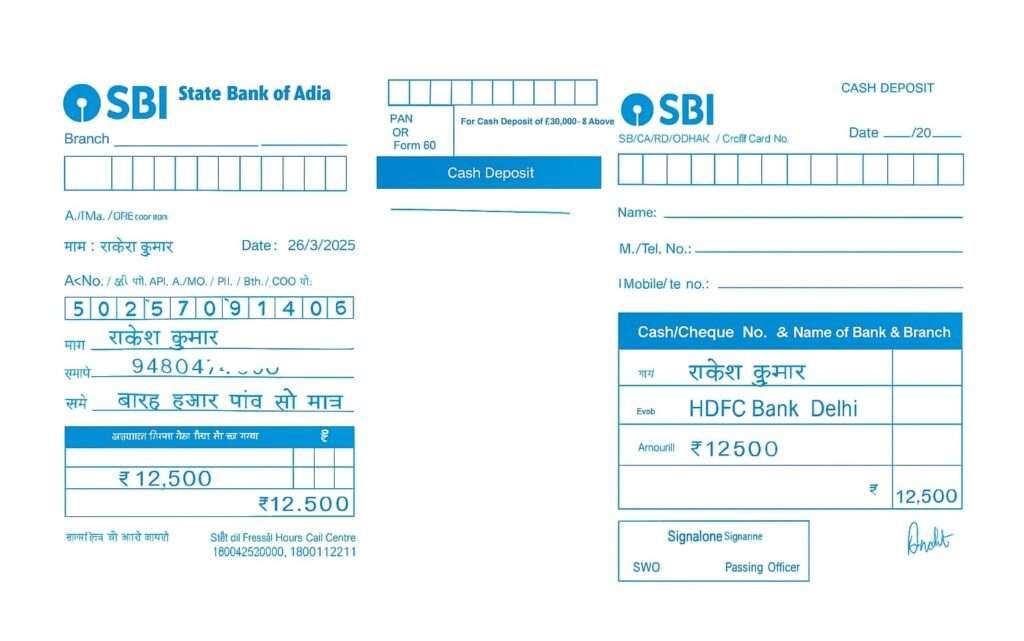

One side is for cash details (like denominations), and the other side is for cheque details. At the end, you detach the counterfoil/stamp part, which acts as your receipt.

SBI Deposit Slip Sections Explained

Every SBI deposit slip has two main sections:

- Customer Copy – stays with you as proof or a deposit token.

- Bank Copy – goes to the teller with your cash or cheque.

The slip asks for basic details like account number, branch, depositor’s name, amount, and mobile number. Once these are correctly written, you only need to focus on whether you are depositing cash or a cheque.

Download SBI Deposit Slip (PDF)

| SBI Deposit Slip | Download Link | Type |

|---|---|---|

| SBI Cash / Cheque Deposit Slip (Sample) | Download PDF |

How to Get an SBI Deposit Slip

Getting an SBI deposit slip is simple. You can use any of these options:

1. Download From the SBI Website

SBI has an online deposit slip, but many users find the link inactive or not working.

So it may not work every time.

2. Collect From the SBI Branch

The safest option is to take the slip directly from the SBI branch.

Most branches only accept the slip they provide, even if you carry a printed one.

3. Use This Sample Slip for Practice

If you want to practice filling out the deposit slip at home, you can use the sample PDF given above.

Where do you start – pen, side, boxes?

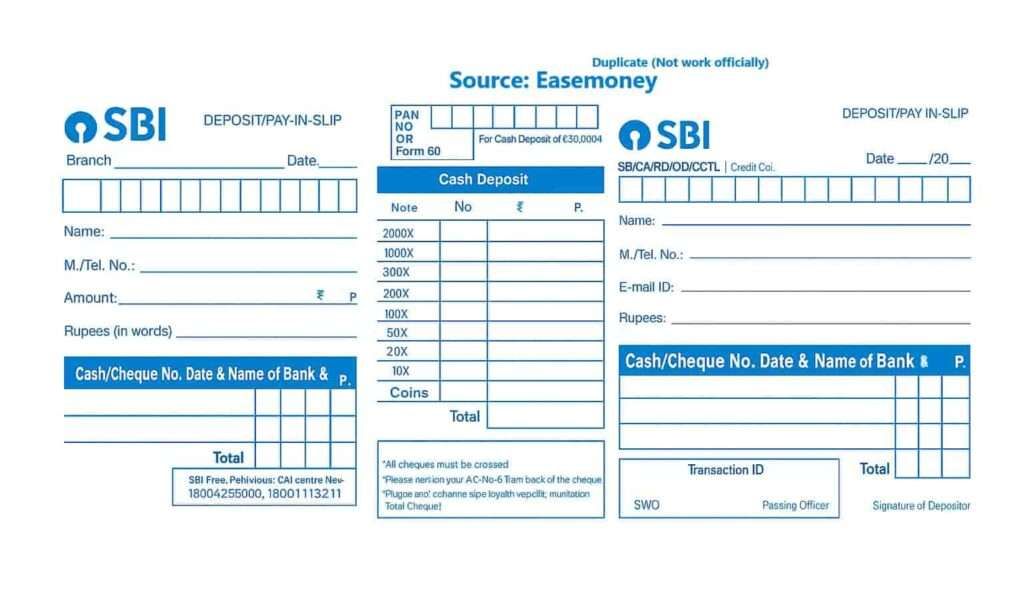

If you are confused about what to deposit slip form looks like, check the above image for it.

You must use a blue or black pen. mostly blue, and write inside the printed boxes, one digit per box. You can start on the left half of the slip first (that’s the branch, SB/CA number, which is printed).

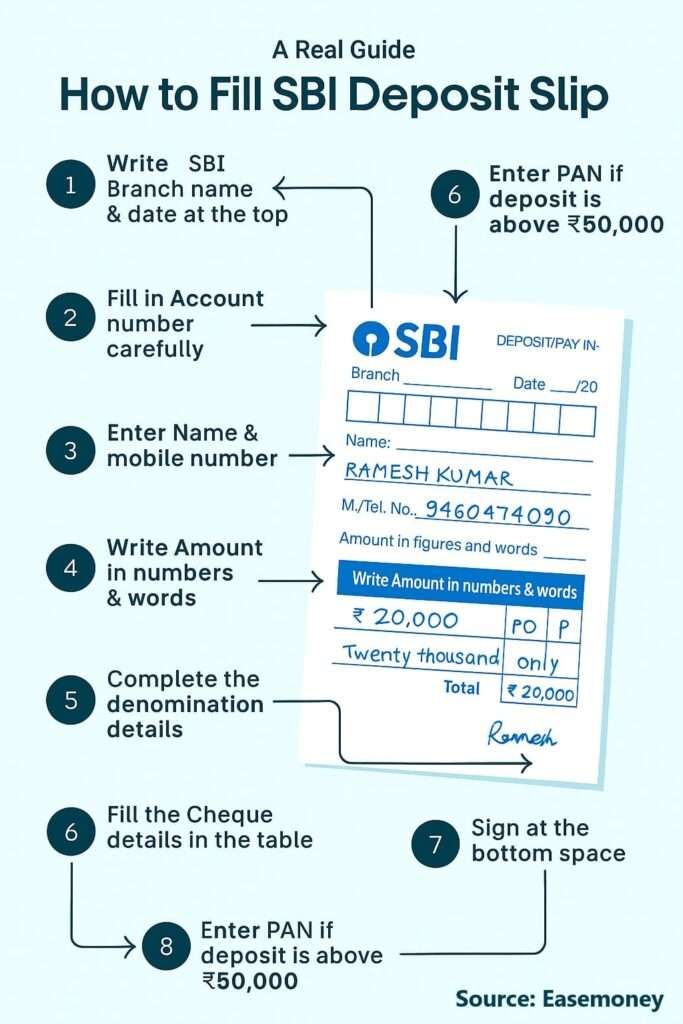

Which three fields must come first for both cash and cheque deposits?

- Branch Name

- Date (DD/MM/YYYY)

- Account number & Name

- Email ID (optional)

These details must be provided for the account holder to be credited directly.

Get these down before anything else. If you are depositing for someone else, write their account details and name; your own mobile number is fine for SMS alerts or any help.

PAN or Form 60 – when and where?

If the amount is ₹50,000 or more (cash or cheque), write your PAN in the small box near the top. No PAN available? Bring and submit Form 60. Below ₹50,000, this box can stay empty.

Step-by-step: Filling the SBI deposit slip for Cash

1 Step – Write the Date, Account number, and Branch

Don’t leave them blank; without these, the slip won’t be accepted.” Please write one by one.

2 Step – Identify yourself

- Name: the depositor’s name. If you are depositing for a friend/family, write your name here and the beneficiary’s name in the “Account Name” line if present. If there’s only one “Name” line, write the account holder’s name only.

- Mobile number: your active number or account holder number (helps the branch contact you if the cash count differs).

3 Step – Amount entries—figures first, then words

- Amount (₹): Write the total intended deposit. You have to align numbers to the box and leave no empty box between digits.

- Rupees (in words): write your depositing full amount after calculating each denomination and end with “only”. Also, avoid symbols, commas, and short forms here.

- For example: If you are depositing ₹5,250, write “5250” in figures and “Five thousand two hundred fifty only” in words.

4 Step – Break down the cash by denomination

In the “Cash Deposit” table:

This is the part most people miss or get confused about. The slip has rows for cash notes.

- ₹2000 notes – write how many you are depositing.

- ₹500 notes – enter count.

- ₹200, ₹100, ₹50, ₹20, ₹10 notes – fill accordingly.

- Coins – mention total coins and their value.

At the end, calculate the total and write it in the “Total Cash” column. You can use our free cash denomination tool for quick calculation.

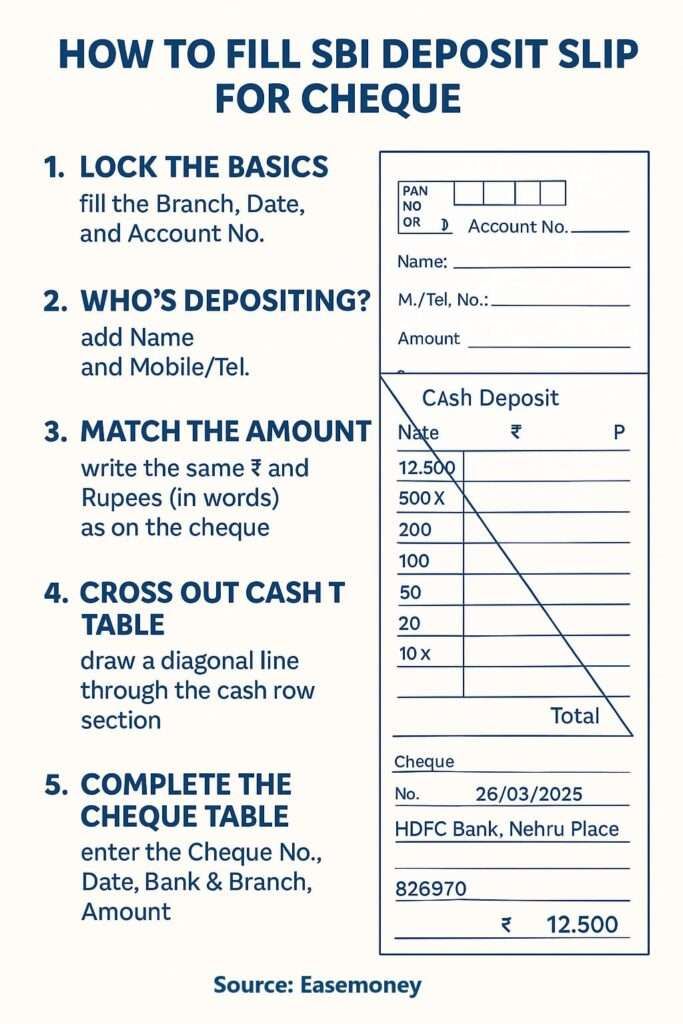

5 Step – Ignore the cheque table for a cash deposit

Draw a single diagonal line across the cheque detail box. That tells staff you are not depositing cheques with this slip.

6 Step – Sign once and now, not at the desk

At “Signature of Depositor”, sign as you normally do. Don’t write anything in boxes named as “SWO/Passing Officer/Transaction ID”; those are for the bank staff only. Your sign is required, even if it’s not your account.

7) Hand-over sequence that actually works

- Place the cash on top, slip below, PAN copy/Form 60 (if applicable) under that.

- Keep the passbook ready if the branch insists on an update.

- Receive the stamped counterfoil (the detachable part right small side). Check that it shows account number, date, and amount correctly before leaving.

8) If the amount is large or the notes are mixed

- For very mixed notes, write the denomination table first, then copy that sum to the “Amount” field. It prevents a mismatch.

- For ₹50,000+, expect an ID/PAN check at the cash deposit counter. Without a PAN or a valid Form 60, cash won’t be accepted.

How to Fill up an SBI Deposit Slip for a Cheque easily

Cheque deposits usually require different details and fill-ups compared to cash. let check it out –

1. Write the Total Amount same as the cheque

- After listing all cheques, calculate and write the total at the bottom. If single check, enter the same amount as mentioned, including Paisa if mentioned.

- Even for cheques, you must write the total in words. For example: “Ten thousand four hundred only.”

2. Enter Cheque Details

The slip has a column for the cheque as a “Cash/Cheque No., Date & Name of Bank & Branch”. Here’s how to do it:

- Cheque Number: Copy the 6–8 digit number from the top right of the cheque. Write this number first in the box.

- Date: Enter the same cheque’s date (DD/MM/YYYY). Post-dated cheques won’t be credited before that date.

- Bank & Branch: You have to enter the same bank name where it cheque came from, and also include the branch name printed in the header of it. (Such as HDFC Bank, Nehru Place)

- Amount: write exactly as on the cheque.

3. Attach the Cheque to the Slip and Submit

- On the back side of the cheque, write “credit to SBI A/C 2311XXX your account number and full name”. Also, you’re signed. This links the instrument to your slip if they get separated.

- Staple the cheque to the top-left corner of the slip and sign the slip in the depositor’s signature field.

- Submit it to the cash counter.

Note: Typical clearing time is 1 or 2 days at most local branches, but in most cases, as per SBI cheque policy data, it can take upto 7 working days if different cities or outstations are under the Cheque Truncation System (CTS).

How to Find an SBI Deposit Slip?

- At the branch counter: usually stacked near the deposit desk with other customer forms.

- Sometimes at the enquiry desk or near the passbook update machines. You can confirm with security guards or bank staff.

- You can even print/download blank SBI deposit slips from online sources, but it will not work at the branch for official works, as it is not the official paper format provided by the bank.

Are they different SBI deposit slips for a savings account and a current account?

Not really. The deposit slip design is the same whether you’re depositing into a savings, current, recurring deposit (RD), or loan repayment account. The only thing that changes is the account number you mention.

What mistakes must you avoid while filling out –

- Leaving sections blank – Always cross unused sections with a straight line.

- Messy handwriting – Staff may misread your account number. Write in block letters if possible.

- Not attaching a cheque – Many forget to pin/staple. Always attach securely.

- Forgetting the account number on the cheque backside – Very common, causes delays.

- Wrong amount in words vs. numbers – If they don’t match, your slip will be rejected.

Can you fill an SBI Cash deposit for someone else’s account?

Yes, absolutely. You can deposit cash or a cheque into another person’s SBI account. Just write their account number and name on the slip. Your own mobile number can be required to verify you.

Is the SBI deposit slip available in Hindi?

Yes, many branches provide bilingual deposit slips. You can write it in hindi on slips; it will be accepted if the bank staff reads it correctly.

Can I deposit coins using an SBI deposit slip?

Yes, you can deposit coins by mentioning the number and value in the “Coins” row of the cash denomination table in the slips.

Can SBI reject my deposit slip even if the cash amount is correct?

Yes. If the account number or name is unclear, SBI may reject it despite the correct cash. Teller priority is account accuracy first, money second. Rewriting the slip usually solves it instantly.

Is it compulsory to cross unused sections on an SBI deposit slip?

Practically yes. SBI staff expect unused cash or cheque sections to be crossed. Leaving them blank can raise suspicion and slow verification, especially during peak hours or high-value deposits.

Can I deposit cash at SBI without mentioning my mobile number?

Yes, mobile number is optional. But adding it helps SBI contact you if there are cash count mismatches. For deposits above ₹50,000, staff usually insist on a reachable number.

Is there a limit on how many notes SBI accepts in one cash deposit?

No fixed note limit, but very mixed denominations, slow counting. For smoother deposits above ₹20,000, grouping notes properly saves 5–10 minutes at the counter.

How long should I keep the SBI-stamped counterfoil safely?

Keep it until the credit reflects plus at least 2 working days. For cheques, retain it until final clearance. It’s your only proof if posting errors occur.

Does SBI accept deposit slips filled in Hindi only?

Yes. SBI accepts Hindi or bilingual slips. Just ensure numbers are clear and readable. Metro branches may prefer English, but Hindi slips are legally valid across all branches.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.