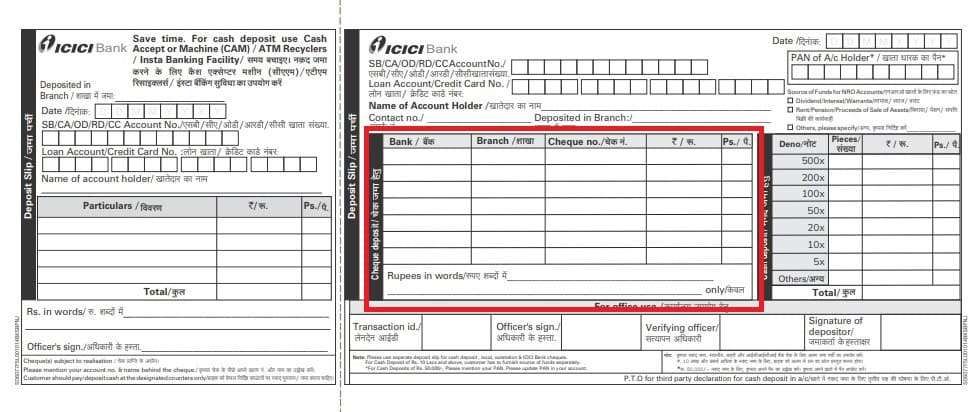

An ICICI Bank deposit slip is a small form used to submit money directly into an account. It works for both cash and by cheque. It is bilingual and available with pre-printed deposit forms at the counter.

You have to write a few details twice, because it has a two-section one for you as proof of you making a deposit, and the second for the bank.

You can skip this deposit paper completely with cash deposit machines (CDM), ATM recyclers, or Insta Banking via the iMobile app.

How to Download ICICI Bank Deposit Slip PDF

Still, if you want the PDF for reference or practice, you can download the bilingual (Hindi–English) deposit slip or any local language here:

- First of all, you have to go to the ICICI Bank official website.

- Look at the top menu header and tap on the Help section.

- Now, scroll down and select Form Centre.

- Under form categories, choose Deposit.

- Choose Deposit Slip from the list.

- Here, you get upto 20 Regional Languages deposit slips.

- You can download deposit slips in Assamese, Bengali, Tamil, Telugu, Kannada, Urdu, Gujarati, Punjabi, and more.

- Tap download to save the PDF deposit slip on your PC or Smartphone.

Does a Printed PDF Work at ICICI Branches?

Yes, the e-Pay-In Slip online fillable deposit slip form. If you print and carry the slip, most branches will accept it because it comes directly from ICICI’s website, not from third-party PDFs.

However, some branches still only accept counter-issued slips, because their official slips are branch-coded and stamped for internal scanning. If you bring a printed PDF, staff may ask you to rewrite the details on their official paper slip.

Filling the ICICI Deposit Slip for a Cheque

Usually, people are more confused about cheque deposits via a slip than about cash. Let me tell you first, a deposit slip is the same, but you have to write down information in different boxes. To fill one correctly, here are the steps:

- Firstly, in the header, by using of blue pen, write the current date in simple Boxes in DDMMYYYY.

- Just below, arrange your ICICI account number in the boxes without missing any box. The cheque amount will be credited to this account.

- Skip this loan/credit card section.

- It has two parts, so you have to fill in the same information in both sections, such as account holder name, contact number, and branch name.

- In particular, write just “cheque” and the amount in Rs.

- In the cheque details section, note:

- You have to put the bank name and, branch where the cheque is from.

- 6-digit cheque number, it is printed bottom of the leaf.

- Here, match the same amount as printed on the cheque total amount section.

- In the Rupees in words area, write the exact amount, such as (“Twenty Five Thousand Only”).

- On the right side, sign as a depositor.

- Now, take your cheque and write back of it –

- ICICI Account number

- Date of issue

- Beneficiary name

- Sign if required.

- If depositing multiple cheques, list each cheque separately and calculate a combined total at the bottom of the slip.

- You can ignore the back side of the slip.

- All set, now submit to the cash counter in your branch.

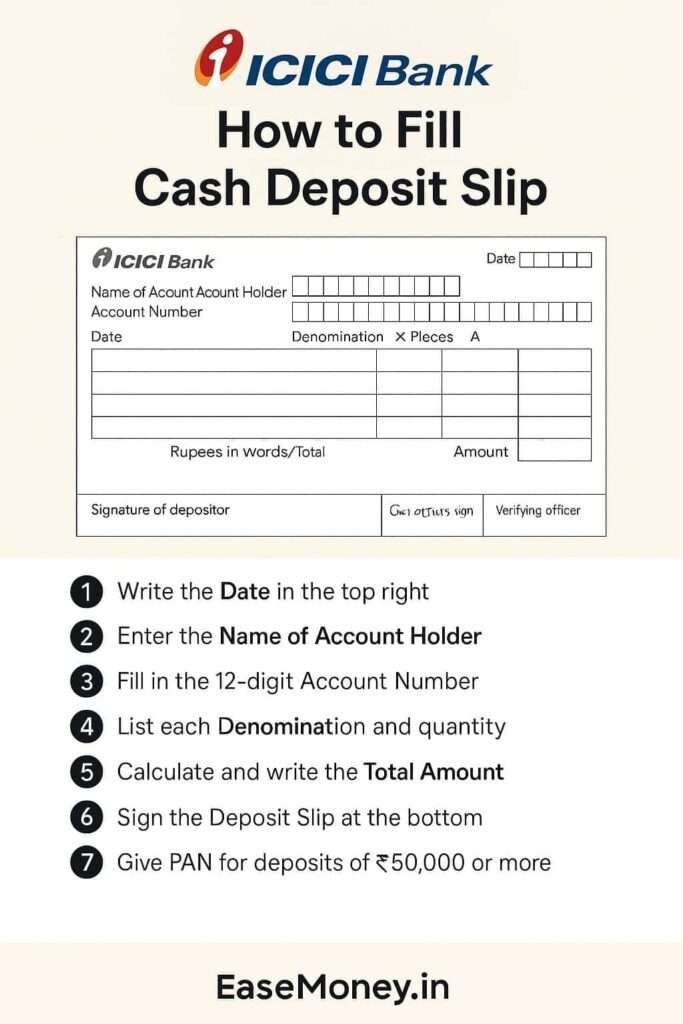

Steps to Fill a Cash Deposit Slip in ICICI

To deposit your money in banknotes, the process is different because you have to provide each note’s details by denomination. follow these steps –

- As I already told you, fill out basic information in the header of the slip.

- Fill in the denominations and count of notes. Example: 200 × 5 = ₹1,000; 100 × 10 = ₹1,000; Total = ₹2,000.

- Add the total and write it in words.

- Mention your PAN if you are depositing ₹50,000 or more. If you don’t have a PAN, attach a signed Form 60.

- If the deposit is ₹10 lakh or above, declare the source of funds (salary, business, property sale, etc.). This is part of RBI’s KYC/AML rules.

- Ignore Officer’s Sign, Verifying Officer, and Transaction ID Fields – bank staff will fill them.

Teller Insight: Cash counters use cash-verification machines. If the counted notes don’t match your slip, the teller will correct the figure in the system before finalising. That’s why filling denominations accurately saves time.

Third Party Declaration (Cash in Someone Else’s Account)

On the back side of the ICICI deposit slip, this information is mandatory only for cash, not for cheque deposits.

If you are depositing cash into another person’s ICICI account (friend, relative, business, etc.), you need to fill in the Third Party Declaration section on the slip.

You must provide:

- Depositor’s Name (if your account, write your name)

- Contact Number

- Relationship with the Account Holder – (write self)

- Deposit Amount

- Purpose of Deposit (e.g., rent, payment, gift, savings and more)

- Declaration that the cash is not for illegal or suspicious purposes (lottery winnings, job offers, etc.)

Finally, sign in the space provided.

Alternative: Insta Banking Digital Slip for Cash Deposit

ICICI now offers a digital version of the deposit slip through the iMobile Pay app under Insta Banking.

Steps:

- Open the iMobile Pay app.

- Select Insta Banking.

- Choose transaction type – cash deposit, cheque deposit, NEFT, RTGS, or demand draft.

- Enter where the money will be account details.

- Submit to generate a reference number via Text SMS on your linked mobile number.

- Visit any branch and go to the “May I help you” counter, give the reference number and give counted cash and coins.

- Bank staff complete the transaction without needing any paper forms or standing in line.

Note: This request auto-expires after a selected period of time if not used.

Cheque vs Cash – Timeframe Difference

- Cash deposits: credited instantly once notes are verified. It takes only 24 hours if any delay happens.

- ICICI Cheque Deposit Processing time: Mostly, cheques are never instant; the bank accepts them for clearing, and funds appear only after realisation, which usually takes 1–3 working days, depending on the branch-to-branch; if different cities, it can take 7 working days.

User Asked FAQs

Can I fill one ICICI deposit slip for multiple cheques together?

Yes, you can mention multiple cheques on a single slip, listing each separately with its amount and calculating the combined total at the Total amount section.

Can I deposit money in ICICI Bank without using a deposit slip?

Yes, you can use Cash Deposit Machines or ATM recyclers. Also, Insta banking if you want a fast transfer.

What’s the safest way to deposit money during peak hours?

Use CDMs or Insta Banking e-slips. Branch experience shows queue time drops by 40–50% compared to manual slips, especially during salary dates and month-ends.

How fast are cheque deposits credited in ICICI now?

Local cheques usually clear in 1–3 working days. Outstation cheques may take up to 7 days. Tip: drop cheques before cut-off time to avoid an extra day.

Is third-party declaration compulsory for cheque deposits?

No. Third-party declaration is mainly for cash deposits into another person’s account. Idea: cheque deposits usually skip back-side declarations unless branch staff specifically request it.

What causes most ICICI cash slip rejections?

Wrong denomination totals or missing PAN details. Branch staff say nearly 60% rejections happen due to calculation mismatch. Always recount notes before submitting the slip.

Why do branches still ask to rewrite details on counter slips?

Some branches use branch-coded slips for scanning and audit. Tip: keep your printed PDF only for practice; rewriting once avoids rejection or delays at busy counters.

Can I deposit large cash amounts without filling a slip?

Yes, via Cash Deposit Machines and Insta Banking. However, for amounts above ₹50,000, PAN or Form 60 is still mandatory, even if no paper slip is used.

Are ICICI paper deposit slips still accepted in 2026?

Yes. Branches still accept paper slips, especially for third-party cash deposits. Tip from counters: digital options are faster, but paper slips remain valid with signatures and PAN if required.

Related Post – Fill SBI Deposit Slip

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.