In India, Post-Dated Cheques (PDCs) were widely used in 2000; they were the standard way to manage EMIs, rent, and business payments. It was quite popular as a Post-credit cheque in india; most government subsidies and school scholarships came as PDC. But Today, As per RBI recent report in 2024/2025, cheques account for under 3% of payment volumes, including PDC. All reduce, the E-NACH, Aadhaar seeding, UPI, dominate this space.

What is the real meaning of Post-Dated Cheque?

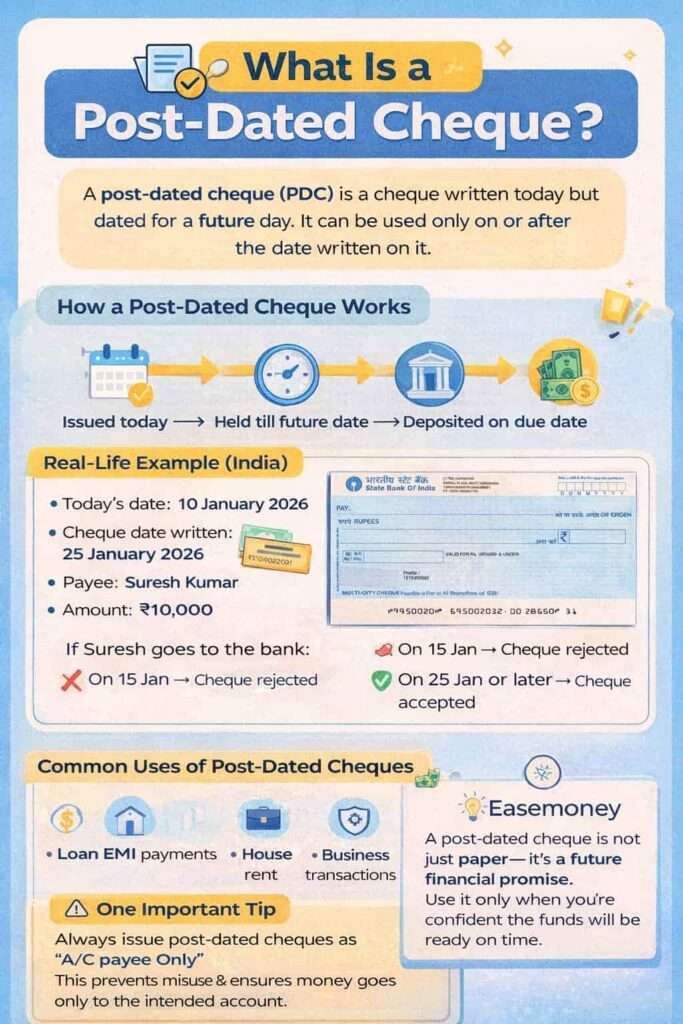

A post-dated cheque (also popularly known as a Future-Dated Cheque) is a cheque leaf written today but dated for a future day. It is making it payable only on or after that date. In India, it is a legally recognised instrument used mainly for planned future payments such as EMIs, rent, and business settlements. A post credit cheque is not just an paper, it is future financial promise in indian legal term, so, use it only when you are confident the funds will be ready on entered date.

When someone issues a post-dated cheque, the simple meaning, you can learn it – “I do not want this money to be taken today — but I guarantee payment on this future date.”

- So, until that date arrives, your cheque cannot be cleared by any bank. It is scheduled for a selected date.

- Once the date arrives, it becomes a normal cheque payable on demand. Also, it does not matter; it is a bearer cheque, an order cheque, or a cross cheque.

Let me give you a quick Simple real-life example with image –

- Today: 10 January 2026

- Cheque date written: 25 January 2026

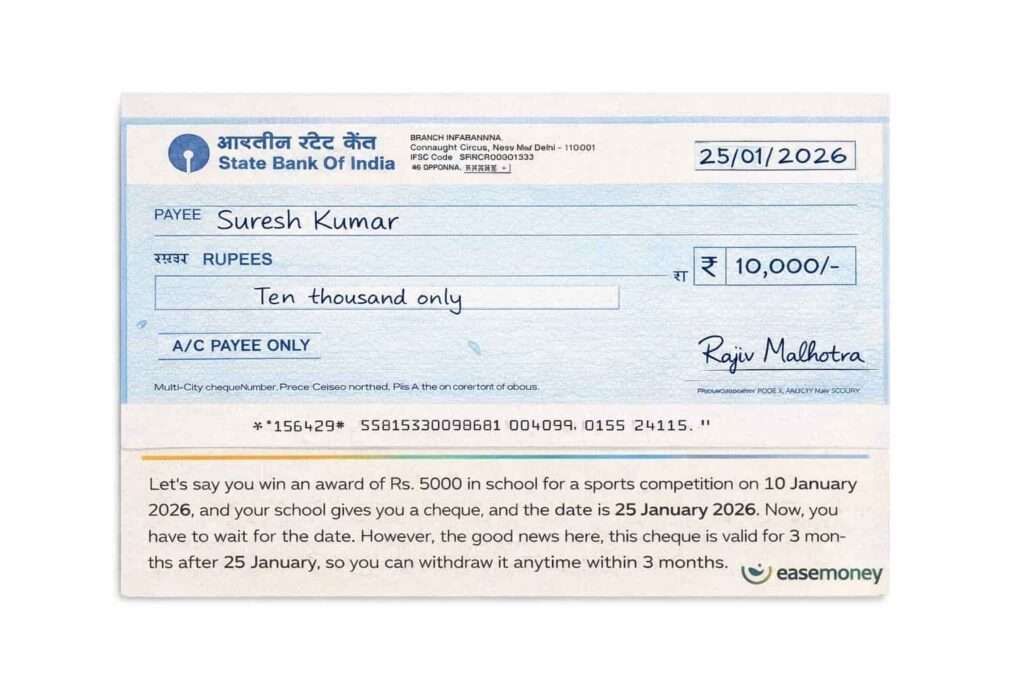

Let’s say you win an award of Rs. 5000 in school for a sports competition on 10 January 2026, and your school gives you a cheque, and the date is 25 January 2026. Now, you have to wait for the date. However, the good news here, this cheque is valid for 3 months after 25 January, so you can withdraw it anytime within 3 months.

Legal Nature of a Post-Dated Cheque in India

Under Indian law, a post-dated cheque is not informal or symbolic. It is a recognised negotiable instrument. under the Governing Law Act, 1881. These leaf all banking operations regulated by the Reserve Bank of India.

Legally, such an instrument is treated as a bill of exchange until its due date, and automatically converts into a cheque on that date.

Key legal position

- A PDC represents a promise to pay a legally enforceable debt

- Once the written date arrives, it becomes a cheque payable on demand

- Dishonour after the due date can attract criminal liability. It does not have any new criminal IPC; it counts the same as a normal cheque bounce. You can read this blog to know more – How Can You Defend or File a Cheque Bounce Case in India?

Courts have repeatedly held that post-dated cheques are fully enforceable, provided a valid debt exists on the date of presentation.

What is the Validity of the leaf (RBI Rule)

As per RBI instructions, effective 1 April 2012, all types of cheques, including post-dated cheques, are valid for 3 months from the date written on the cheque.

In simple terms, a cheque dated 15th May 2025 is valid until 14th August 2025 (three months from the date written on it). On 15 August, it became a waste of paper, stale and invalid, as per the law. The RBI-mandated rule is No premature clearing allowed before 15 May 2025, it means, if someone gives you on 1 Jan 2025, you have to wait for months.

Positive Pay System (PPS) — RBI’s Security Layer

The Positive Pay System (PPS) is a fraud-prevention mechanism introduced by the RBI under CTS.

How PPS works

When issuing a cheque, the drawer submits:

- Cheque number

- Date

- Amount

- Payee name

This is done via net-banking, mobile app, or branch.

Mandatory thresholds

- Optional for cheques ₹50,000 and above

- Often mandatory for ₹5,00,000 and above (bank-specific)

If PPS details are not confirmed for mandatory cheques, the cheque is returned unpaid, even if funds exist.

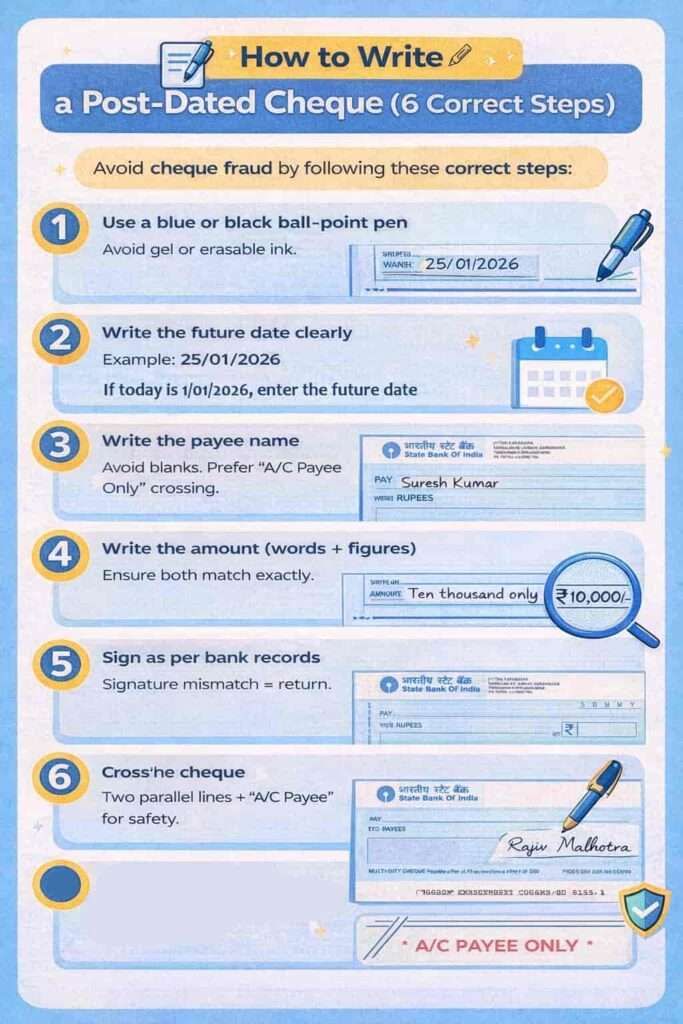

How to Write a Post-Dated Cheque (6 Correct Steps)

There is no difference in regular cheque writing from a post-dated cheque; you will need the same stuff, but the only change is here, the date. You have to write the selected date, as if you were writing a cheque for payment of a credit card. Your salary came on 1 August, and your billing date is 20 August. Simply, enter 20 August 2026 on the cheque; it is your post-credit cheque writing method and maintain the balance to avoid a cheque bounce.

Step 1: Use a blue or black ball-point pen

Avoid gel or erasable ink.

Step 2: Write the future date clearly

Example: 25/01/2026

Step 3: Write the payee name

Avoid blanks. Prefer “A/C Payee Only” crossing.

Step 4: Write the amount (words + figures)

Ensure both match exactly.

Step 5: Sign as per bank records

Signature mismatch = return.

Step 6: Cross the cheque

Two parallel lines + “A/C Payee” for safety.

Are Post-Dated Cheques Still Relevant Today?

Yes, But less dominant than before, the sharp decline happen after the Auto-pay EMI system launch. however, there is still 50 lakh cheques payments happen every month in india, it means still lakhs of post-dated cheques happen in market.

Where they are still widely used

- Loan EMIs (especially outside full digital mandates)

- Rent in semi-formal arrangements

- Business credit cycles

- Security deposits

Why usage is declining

- Rise of NACH, ECS, NEFT, RTGS, UPI

- Physical handling risks

- Administrative burden

- Legal exposure in case of bounce

Digital systems now offer automation without criminal risk, which many prefer.

Why Post-Dated Cheques Exist (The Real Reason)

Post-dated cheques did not emerge because of law, but they emerged because of cash-flow reality.

Core reasons people use PDCs

1. Time alignment between income and expense

Many individuals and businesses know when money will come in (salary, revenue, receivables) but not today.

2. Scheduled obligations

- Loan EMIs

- Monthly rent

- Installment-based purchases

PDCs convert uncertain future cash into a fixed payment commitment.

3. Trust without immediate cash

A PDC allows transactions even when instant liquidity is missing, but trust exists.

4. Legal seriousness

Unlike verbal promises, a cheque carries formal accountability, which is why payees accept it.

“Post-Dated Cheque on a Crashing Bank” — Gandhi’s Metaphor

The phrase “post-dated cheque on a crashing (or failing) bank” was used by Mahatma Gandhi in 1942 to criticise the British government’s promise of future independence for India under the Cripps Mission.

It was not about banking or cheques in a literal sense. but, It was a political and moral metaphor meant to expose why the British offer could not be trusted.

What was the background?

During World War II, Britain urgently needed India’s support. To secure cooperation, the British government promised Dominion Status for India after the war, without transferring real power immediately.

Gandhi rejected this offer.

A post-dated cheque is a promise of payment in the future, not now.

By using this term, Gandhi meant:

- Independence was postponed, not granted

- Indians were asked to trust a future assurance

- There was no immediate control or sovereignty

In simple words:

“You are asking us to wait again.”

FAQs

What are the rules for post-dated cheques in India?

A post-dated cheque can be used only on or after its written date, stays valid for three months, and must have funds available that day, or the bank will return it unpaid.

What happens if a post-dated cheque bounces after its date?

If a post-dated cheque bounces due to low balance, the issuer may face legal action within 30 days, including fines up to twice the cheque amount or imprisonment.

Why are post-dated cheques riskier today than before?

Earlier, cheque clearing took days. Today, many cheques clear the same day, so even a one-day balance gap can cause an immediate bounce and legal notice.

Can I stop or cancel a post-dated cheque after issuing it?

You can request stop-payment before deposit, but if money was genuinely owed on that date, courts may still treat the bounced cheque as default, regardless of the stop request. you can stop cheque payment via mobile banking app or internet banking of your bank portal.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.