RTGS Transfer Methods and Limit

According to the RBI, the minimum amount you can send through RTGS is ₹2 lakh, while there is no maximum capped amount; however, the bank sets its own internal limits.

Usually, it depends on what method you are using for RTGS, such as –

| Method | Minimum | Maximum | Key Note |

|---|---|---|---|

| Branch via Cheque | ₹2 lakh | Bank-set limit (₹10–50 lakh typical) | Most common branch method |

| Branch via Account Debit | ₹2 lakh | Varies by bank policy, it goes only to 10 Lakh last. | Some banks prefer a cheque instead |

| Branch via Cash | Not allowed | Not allowed | Only NEFT up to ₹49,999 permitted |

| Internet Banking (No form required) | ₹2 lakh | Online cap ₹25–50 lakh (retail) | Free of charge, 24×7 |

| Mobile Banking App (No physical form required) | ₹2 lakh | Same as the net banking limit | Instant, secure, with UTR alert |

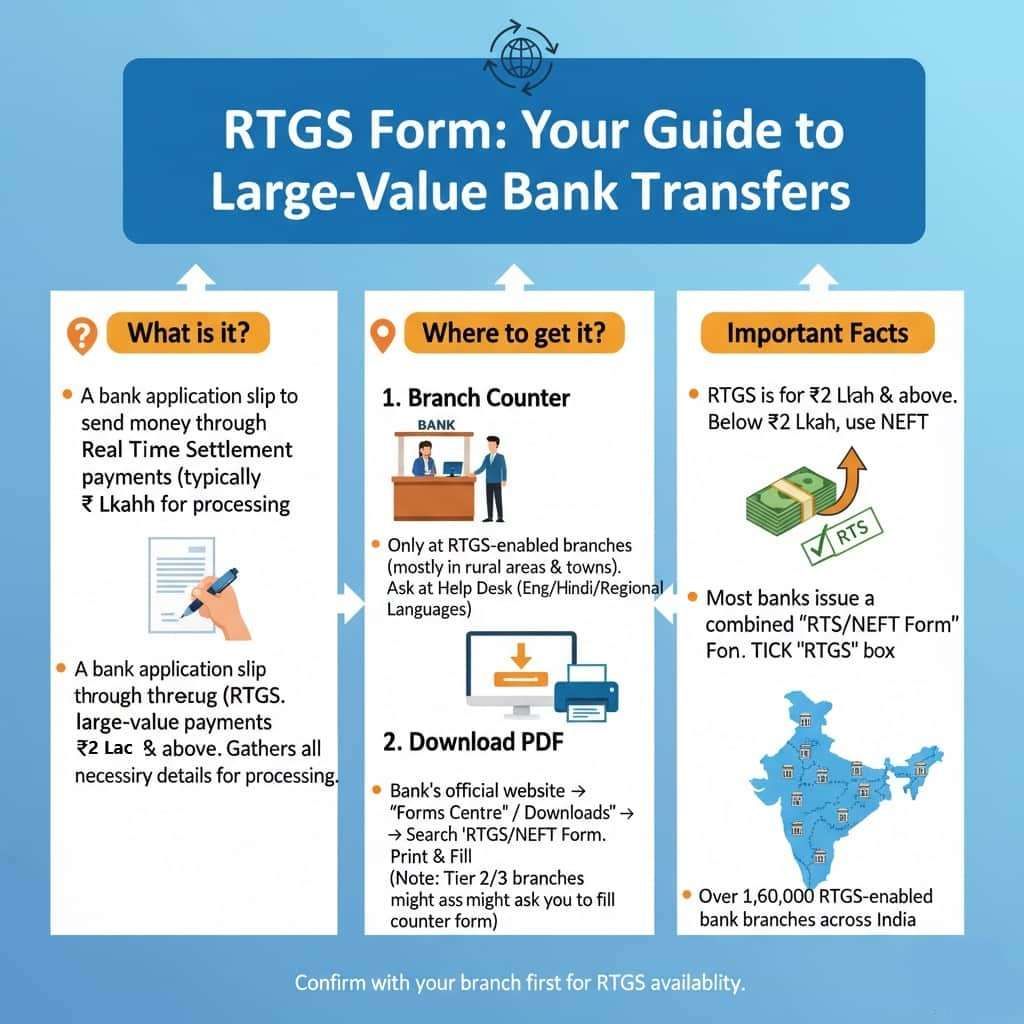

What is the RTGS form?

For branch banking, you will need the RTGS Form, which is a simple application slip that you fill out at the bank branch whenever you want to send money through Real Time Gross Settlement.

Since RTGS is designed for large-value payments, the form makes sure the bank has every detail it needs before processing the request.

These payments are only performed on selected RTGS-enabled branches, mostly in rural areas, and towns have a big branch which usually RTGS-enabled.

You have to confirm with your branch first. Fun fact, there are a total of 1,60,000 RTGS-enabled bank branches across India.

Most customers are confused here. Usually, Most banks in India issue a combined RTGS/NEFT form, so you must tick the RTGS box for any selected transaction. For any transfer below Rs. 2 Lakh, you can go with NEFT.

Where to Get RTGS Forms

- Branch Counter – It is not widely available, only RTGS-enabled branches.

- Visit and collect from the help desk, usually bilingual (English & Hindi).

- For a cooperative or a gramin bank branch, you can ask for religious language forms as well.

- Download PDF –

- Go to your bank’s official website.

- Look for “Forms Centre” or “Downloads.”

- Search for ‘RTGS/NEFT Application Form PDF.’

- Download the form — usually provided in English, Hindi, and many more regional languages.

- Print it, fill in the details, and carry it to the branch.

Note: Most bank branches accept RTGS Fillable PDF self-printed forms. However, most tier-2 or tier-3 area branches ask you to fill again an available form at the counter.

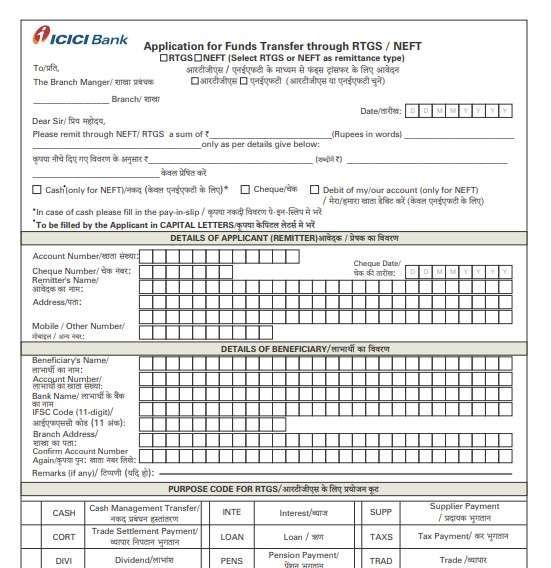

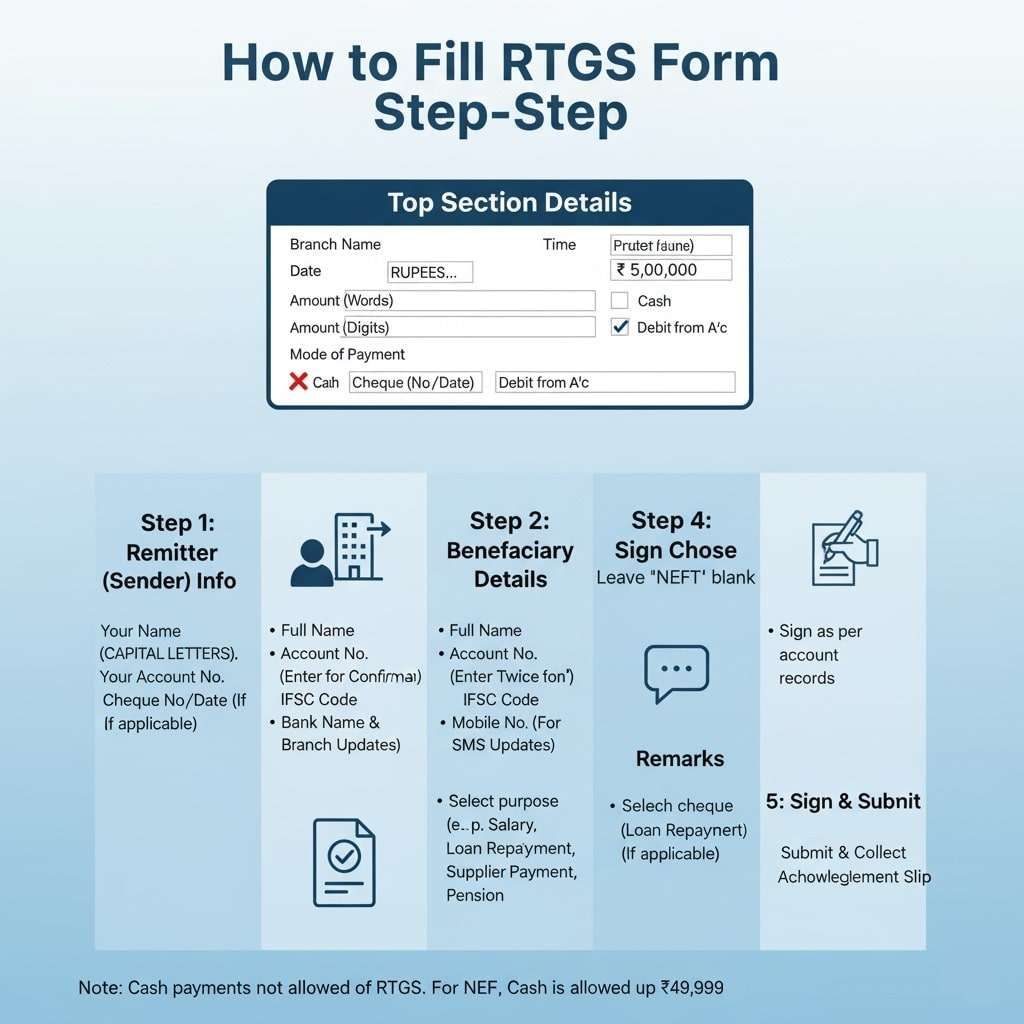

How to Fill RTGS Form Step by Step

The top of the pay-in slip starts with the Branch name, date, time, your Fund amount in words and digits. Now, select the mode of payment, such as Cash, cheque, or deducted from a/c digitally. You can tick it. (Remember, not every method works for RTGS.)

Step 1: Enter Remitter Information (The sender A/c details here)

- Write your name clearly in CAPITAL LETTERS.

- Put down your account number (from which money will be debited).

- If using a cheque, write the cheque number and date.

- Cash is generally not allowed for RTGS (only for NEFT, up to ₹49,999).

2 Step: Beneficiary Details (Where your money will transfer)

- Full name of the beneficiary.

- Account number (enter twice to confirm).

- IFSC code of the beneficiary’s bank branch.

- Bank name and branch address.

- Mobile number for SMS updates.

Step 3: Choose Transaction Type

- Tick RTGS in the application box.

- Leave the NEFT option blank.

4 Step: Remarks

Banks provide remarks (salary, loan repayment, supplier payment, pension, etc.). Select the most suitable for you.

5 Step: Signature and Submission

- Sign the form as per your account records.

- Attach a cheque if paying by cheque.

- Submit the form at the branch and collect the acknowledgement slip.

Quick Example of a Written RTGS Form

| Field | Sample Entry |

|---|---|

| Date | 21-09-2026 |

| Branch | SBI – MG Road Branch, Bengaluru |

| Remitter Name | Suresh Kumar |

| Account Number | 456789001234 |

| Cheque Number | 112233 (6 digits only) |

| Cheque date | 21-09-2026 (if same) |

| Beneficiary Name | Arvind Singh |

| Beneficiary Account Number | 998877665544 |

| Confirm Account Number | 998877665544 |

| Beneficiary Bank | HDFC Bank, Connaught Place, New Delhi |

| IFSC Code | HDFC0000456 |

| Amount | ₹3,50,000 |

| Purpose Code | Supplier Payment (SUPP) |

| Remarks | Material payment |

| Signature | [Signed] |

Note: These are general steps that work on all receipts. If you want something specific, depending banks to banks, check below –

Bank-Specific RTGS Form Guides

| Bank Guide | Notes & Insights |

|---|---|

| Yes Bank | Explains Yes Bank’s combined RTGS/NEFT form with bilingual options. |

| ICICI Bank | Covers ICICI-specific rules, such as mandatory cheque above ₹1 lakh. |

| Indian Bank | Provides English and Hindi PDF forms with detailed filling instructions. |

| Bank of Baroda | A proper left side is the customer copy, and the right side is the bank copy. |

| Kotak Bank | Upto 13 languages Zip available at the Kotak website. |

| State Bank of India (SBI) | Upto 3 options to download PDF + Self-cheque are required |

| Canara Bank | You can download both hindi and English separate forms |

| HDFC Bank | Use an editable form + 15 languages + AI options to download it. |

| Axis Bank | Axis offer RTGS/IMPS/NEFT 3-in-1 Application form. |

| Punjab National Bank (PNB) | PNB offer RTGS/NEFT/DD-supported bilingual form. |

| Bank of India (BOI) | BOI have multiple design forms just for RTGS. |

| IDBI Bank | A simple bilingual form that supports DD/NEFT/RTGS and lots of slots. |

| Union Bank of India | You can download the MS Word version RTGS form also. |

| Indian Overseas Bank | A single separated form only for RTGS, easy to write. |

| Central Bank of India (CBI) | Multiple forms depending on the payment option, such as cheque-based RTGS or Account-based RTGS |

| IndusInd Bank | The form name is Application cum Debit Authority Form for DD/RTGS/NEFT/IMPS Transfers. |

| Bank of Maharashtra (BOM) | They offer two forms – the RTGS-only form and the NEFT/RTGS Form |

| IDFC First Bank | IDFC offer an editable and fillable PDF form directly on their official website |

| RBL Bank | They offer ATAT, RTGS, NEFT, DD single form for all payment mode. |

What RBI Guidelines Say About RTGS

- RTGS is for large-value, time-sensitive transactions.

- ₹2 lakh minimum per transfer.

- Credit is based on the account number only, not the beneficiary name.

- Customers receive a UTR (Unique Transaction Reference) number for every RTGS transfer.

- Refunds for failed transactions must be processed quickly by the bank.

Using a Cheque for RTGS

- At most branches, RTGS is processed through cheque submission.

- Write a cheque in favour of “Yourself” and put down the exact RTGS amount.

- Submit this cheque along with the filled RTGS form.

- The bank debits your account and processes RTGS against the cheque details.

(Example: In SBI, you cannot do RTGS via cash; a cheque is mandatory.)

Customer Acknowledgement Slip

After submitting your RTGS form at the branch, the teller returns a stamped slip that includes:

- UTR number or Reference ID

- Date and time

- Amount transferred

- Branch seal and signature

Keep this safe until your beneficiary confirms receipt. It works as proof, and you can use it to track your request anytime.

What are the charges for RTGS Fund transfer?

The charges are basic and start from Rs. 20 + 18% GST; however, it only works at the branch, you may find higher upto Rs. 50, depending on account type and branch location. But RBI has capped them to keep costs reasonable.

| Amount Slab | Typical Charges (excl. GST) |

|---|---|

| ₹2 lakh – ₹5 lakh | ₹20 – ₹30 |

| Above ₹5 lakh | ₹40 – ₹50 |

Alternatively, you can choose Online Fund Transfer, it free of cost.

How Much Time Does RTGS Take

- Online RTGS: Credited instantly, usually within a 15-minute window.

- Branch RTGS: The approved timing is typically 30–60 minutes; however, you might find it extended if the branch has a heavy workload or any server delay. You may have to wait for the last 2 hours to complete it.

- RBI Guideline: RTGS operates 24×7, 365 days, so delays are usually operational, not system-based.

How to Do RTGS Online

Online RTGS is faster and doesn’t require physical forms. Here’s how:

- Simply Open Your smartphone and log in to your Net Banking or Mobile Banking app.

- Navigate to Fund Transfer in the Account section in the header.

- Add a new beneficiary (enter name, account number, IFSC).

- Wait for 30 mintues cooling period. (if applicable)

- Select RTGS as the transfer mode.

- Enter the transfer amount (check the first capped amount in terms below).

- Confirm using OTP or PIN.

- It will deduct from your savings account.

- Note the Tick number generated.

Still Questions List

How can I track my RTGS transaction after submitting the form?

Yes, you can simply track it using your slip or UTR number printed on your slip, simply call the customer care helpline or just visit your branch.

How do I get a duplicate RTGS acknowledgement slip if I lost mine?

In case you lost it and payment delay, you have to provide valid information related to the RTGS, such as timing, payment mode, UTR number + ID proof at the branch counter.

Can the RBI help me track my RTGS transaction directly?

No, RBI does not handle customer queries. Tracking and resolution must be done through your bank’s branch or customer support.

Is there a way to track RTGS online without visiting the branch?

Yes, many banks provide RTGS tracking by using your internet banking, mobile app, or a “Track Transaction” option on their website.

Can my RTGS get rejected even after filling the form correctly?

Yes. Around 15–20% branch rejections happen due to inactive beneficiary accounts, wrong IFSC, or signature mismatch. Tip: always verify IFSC via passbook or bank website, not WhatsApp forwards.

Is a beneficiary name mismatch a problem in RTGS?

Officially, no, because RTGS credits by account number + IFSC. But many branches still cross-check names manually. Practical tip: keep name spelling reasonably close to avoid teller-level delays.

Why do some branches force a cheque even when account debit is allowed?

A cheque creates a physical debit trail, reducing disputes. In SBI, PNB, and CBI, staff prefer cheque RTGS above ₹5–10 lakh. Carry a signed self-cheque to save one extra visit.

What’s the safest time window to submit RTGS at a branch?

Best window is 10:30 AM–2:30 PM. Early morning queues and post-3 PM server loads cause delays. Submitting before lunch increases same-hour credit probability by nearly 40%, based on branch trends.

Can RTGS fail after UTR is generated?

Rare, but possible in network reversals. If credit fails, banks must reverse funds within a T+1 working day as per the RBI. Always keep the acknowledgement slip until the beneficiary confirms the credit.

Do cooperative or gramin banks handle RTGS differently?

Yes. Many cooperative banks process RTGS through sponsor banks, adding 30–90 minutes. Tip: ask upfront whether RTGS is “direct” or “sponsored” to set correct expectations, especially for urgent payments.

Is it safe to use self-printed RTGS forms from websites?

Mostly yes for metro and tier-1 branches. However, tier-2/3 branches often insist on counter forms due to audit norms. Carry a pen and be mentally prepared to rewrite once.

What common mistake causes the longest RTGS delay?

Incorrect beneficiary account digit count. Even one missing digit pushes the transaction to manual verification, delaying credit by hours. Pro tip: write the account number twice, slowly, before submission.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.