In the FY 2022–23 report at the PIB press release, India processed around 7,109 lakh (7.1 crore) cheque transactions under the Cheque Truncation System. PIB also tells that the volume of cheques grew by 7.7% over the previous year. On an average working day, nearly 50 lakh (5 million) cheques were cleared across the country.

Transaction volume held by UPI dominance, but industry observations (As per Airtel’s banking insights) show that self-cheques still account for around 10% of urban branch cash withdrawals, mainly for urgent, high-value, or branch-mandated transactions.

This is why self-cheques still matter in India.

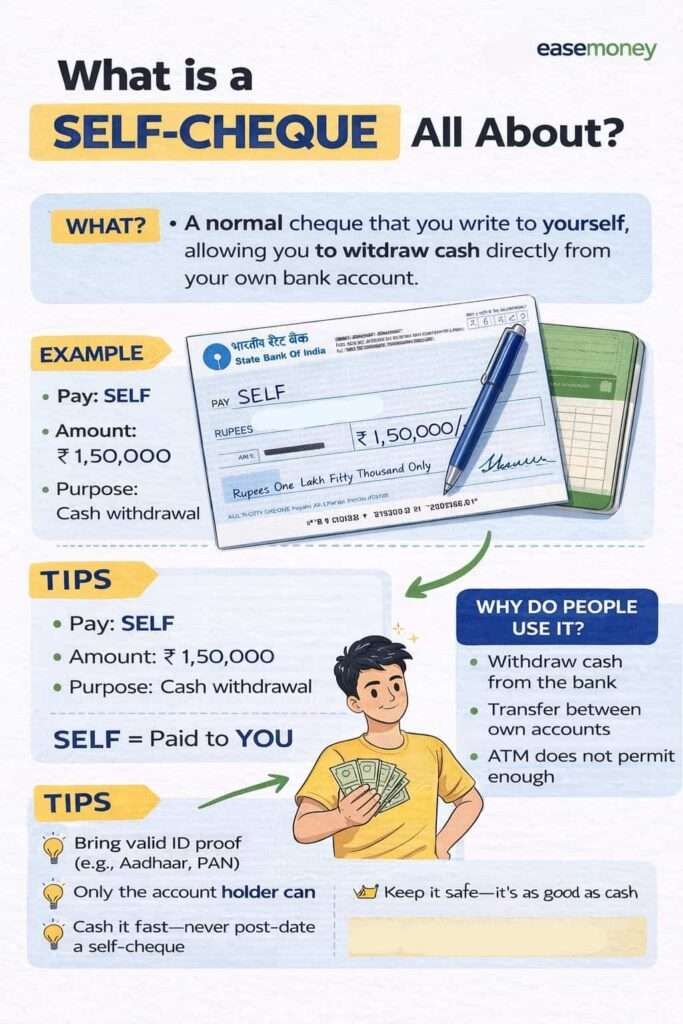

What is a Self-Cheque All About?

A self-cheque is a cheque drawn by an account holder payable to self, when someone writes by hand using black or Blue Ink – “SELF” or “YOURSELF” in capitals. It means authorising the bank to release funds to the drawer. In Indian law, it is not a separate instrument; it is simply a cheque where the drawer and payee are the same person. The cheque must be an open and bearer cheque; it does not have any Crossed or “A/C Payee Only” written on it.

A self-cheque is:

- 100% legal

- Covered under the Negotiable Instruments Act, 1881

- Fully supported under the Cheque Truncation System (CTS), unlike a cancelled cheque.

Systems footing

Self-cheques are fully supported under the Cheque Truncation System. CTS does not differentiate between “self,” “bearer,” or “account-payee” for validity, but it scans the image quality, MICR, number, signature, and instrument correctness.

A real branch moment Example and Sample image (why people still use it)

Mr Ashish Singh, an SME owner, does banking with the State Bank of India. He needs ₹1.8 lakh cash the same morning to close a supplier deal. ATM limits won’t help. UPI is down at the supplier’s end. He writes a self-cheque, walks into his home branch, signs once, shows ID, and walks out with cash—problem solved in minutes. This is the exact gap self-cheques still fill.

People who still use self-cheques

- Business owners and shopkeepers

- Most businesses still want instant cash payments – small SME OR furniture

- Senior citizens and pensioners

- High-value savings account holders

- Rural and semi-urban customers

- Anyone dealing with branch-based banking

Places where self-cheques are commonly required

- Cash withdrawal at bank branches

- RTGS or NEFT is done through the branch forms (most PSU Banks require a self-cheque for RTGS transfer).

- IMPS through the branch (in limited cases)

- Demand Draft (DD) issuance

- Emergency withdrawals when ATMs or UPI fail

- The bank branch requires physical authorisation

- ATM limits are too low

- Digital systems are down (rare)

- Account-to-account transfers during branch processing

What RBI say about

The Reserve Bank of India does not fix any national withdrawal limit for self-cheques or any specific rules against it. But it –

- Allows banks to set limits based on risk and cash availability

- Protects the legal validity of cheques

- Allows banks to ask for ID and verification

In short: RBI sets the framework, banks set the rules.

What are the withdrawal limits across banks in India?

There is no national cap on self-cheques and no bank-specific rules; it is mostly handled by branches and bank policies. Basically, the limits depend on bank type, branch (home vs non-home), account type, and cash availability. But Most individual banks do impose specific daily cash withdrawal limits, which are around ₹1-2 lakh; these are part of their internal policies.

Typical same-day ranges (observed practice):

- PSU banks: It goes around ₹1–5 lakh (home branch), lower at non-home branches, most big PSU banks – SBI, or PNB, work with capped limits. If the amount is higher, you can call the branch first, before requesting a cash withdrawal.

- Private/commercial banks: ₹2–5 lakh (relationship-dependent), These banks are highly standardised and allow higher cash withdrawal easily.

- Small finance banks: ₹50,000–₹2 lakh (cash stock dependent)

- RRBs: ₹25,000–₹2 lakh (highly branch-liquidity dependent)

Above the range: Advance intimation (it takes around 1–2 working days), ID, and approvals are common.

Tax overlay (important): Your Cash withdrawn via a self-cheque counts for Income-tax Section 194N thresholds (cumulative in a financial year). Banks deduct TDS after thresholds are crossed; this is tax compliance. This does not stop withdrawal, but reduces net cash.

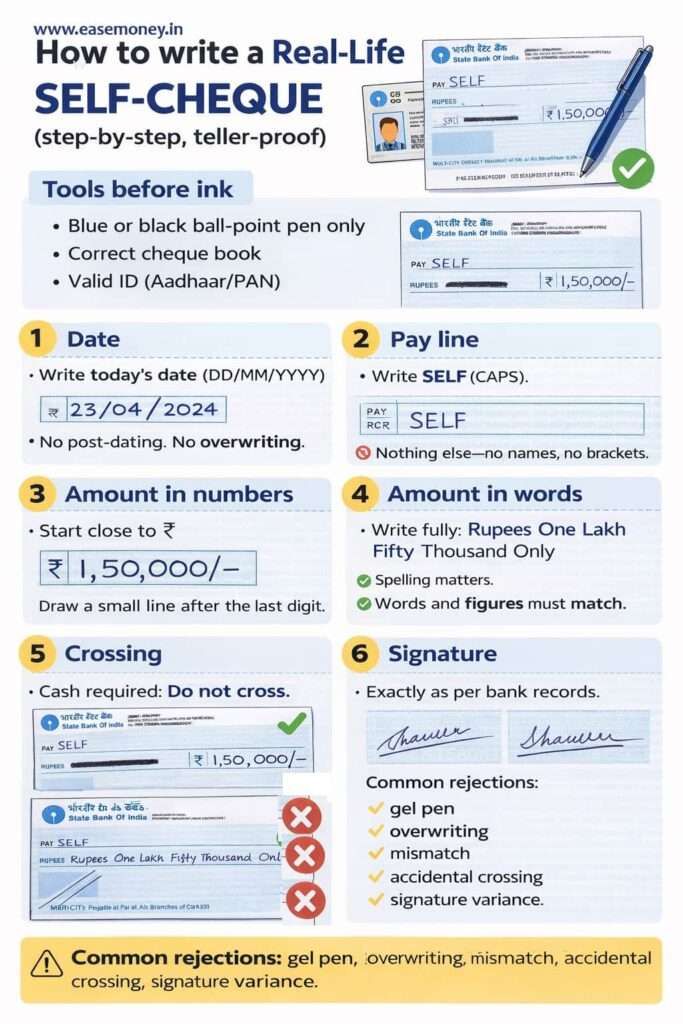

How to write a self-cheque correctly in India

This process is 95% identical across, such as

- PSU Banks (SBI, PNB, BOB, etc.)

- Private / Commercial Banks (HDFC, ICICI, Axis, etc.)

- Small Finance Banks

- Regional Rural Banks (Gramin Banks)

But the real differences are mainly in limits and verification, not the method. Before writing, you have to carry a few things, such as a Cheque book, a blue or black pen (no gel or green, red ink), take your original ID (PAN/DL/Aadhaar). A little bit of patience, this is all you need.

1 Step – Pen & writing rules (banks are strict here)

Simply use a regular branch, provide a pen or a basic Blue or black ball-point pen. The reason is here: CTS scanning + forensic verification.

2 Step – Date (top right)

Now, write the date when you want cash, fill it out using 15/05/2026 and do not enter a future date, it will count as a Post-dated cheque.

3 Step – “Pay” line (The most important for this cheque leaf)

You have to write clearly in CAPITAL letters: SELF

Nothing else. name or symbol, but if you are using a self-cheque for RTGS or IMPS, then you have to write = YOURSELF FOR RTGS.

This rule is identical across PSU, private, SFB, and RRB.

4 Step – Amount in numbers

Write the amount and start close to the ₹ symbol. Then draw a small line after the last digit. Also, no spaces inside numbers. This is basic and the same as all other cheques. However, check your account type withdrawal capped limit before filling.

5 Step – Amount in words

You can write in hindi or English; it is bilingual in nature. Write fully: Rupees One Lakh Fifty Thousand, put only at last. Also, remember no spelling mistakes and start close to the margin.

6 Step – Crossing rules

If you want hard cash in hand, do not do anything now. Many people accidentally cross and lose cash access.

Last but not least, put your sign exactly as per the bank records. You can confirm with the branch, most of the time, banks ask same sign, the backside of the cheque as well.

Tip – Signature mismatch is the #1 rejection reason.

Self-cheque withdrawal by another person

A cheque written as “Self” is meant only for the account holder, so it means another person cannot normally withdraw cash using a self-cheque. Your bank treats self-cheques as personal-use instruments. Banks will not give cash to anyone else, even if they are family.

If you want someone else to withdraw cash on your behalf, so, the best practice is NOT to use a self-cheque. You must use a Bearer Cheque (also called an open cheque). It is simple and direct. You can read here – What Is a Bearer Cheque in India? Meaning & Limits in India

How the bearer withdraws the cash

- Bearer goes to your bank branch with the cheque

- Teller asks the bearer to sign on the back of the cheque

- For higher amounts (commonly ₹50,000+):

- ID may be asked

- The bank may call the account holder

FAQs

Is a self-cheque still useful in India when UPI exists?

Yes. When you need large cash instantly, ATMs fail, or branches require physical authorisation (RTGS, DD), a self-cheque is still the fastest and most accepted offline option.

Can I withdraw cash using a self-cheque from any branch?

You can, but home branches work best. Non-home branches often apply lower limits, stricter ID checks, and may refuse large amounts due to cash availability or internal policy.

What is the self-cheque withdrawal limit at the SBI home branch?

At a State Bank of India home branch, there’s no fixed upper limit. For amounts above ₹2 Lakh or more, advance intimation is usually required so the branch can arrange cash.

Can another person withdraw money using my self-cheque?

No. A self-cheque is meant only for the account holder. If someone else needs to withdraw cash, you must issue a bearer cheque, which carries higher risk.

Is endorsing a self-cheque safe for third-party withdrawal?

Legally possible, but not safe and often rejected by banks. Most branches discourage this due to fraud risk. For regular authority, a Power of Attorney is the correct method.

Why do banks ask for a self-cheque with RTGS or NEFT forms?

The self-cheque acts as written debit authorisation. It replaces digital OTP approval and helps banks verify your signature before processing high-value branch transactions.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.