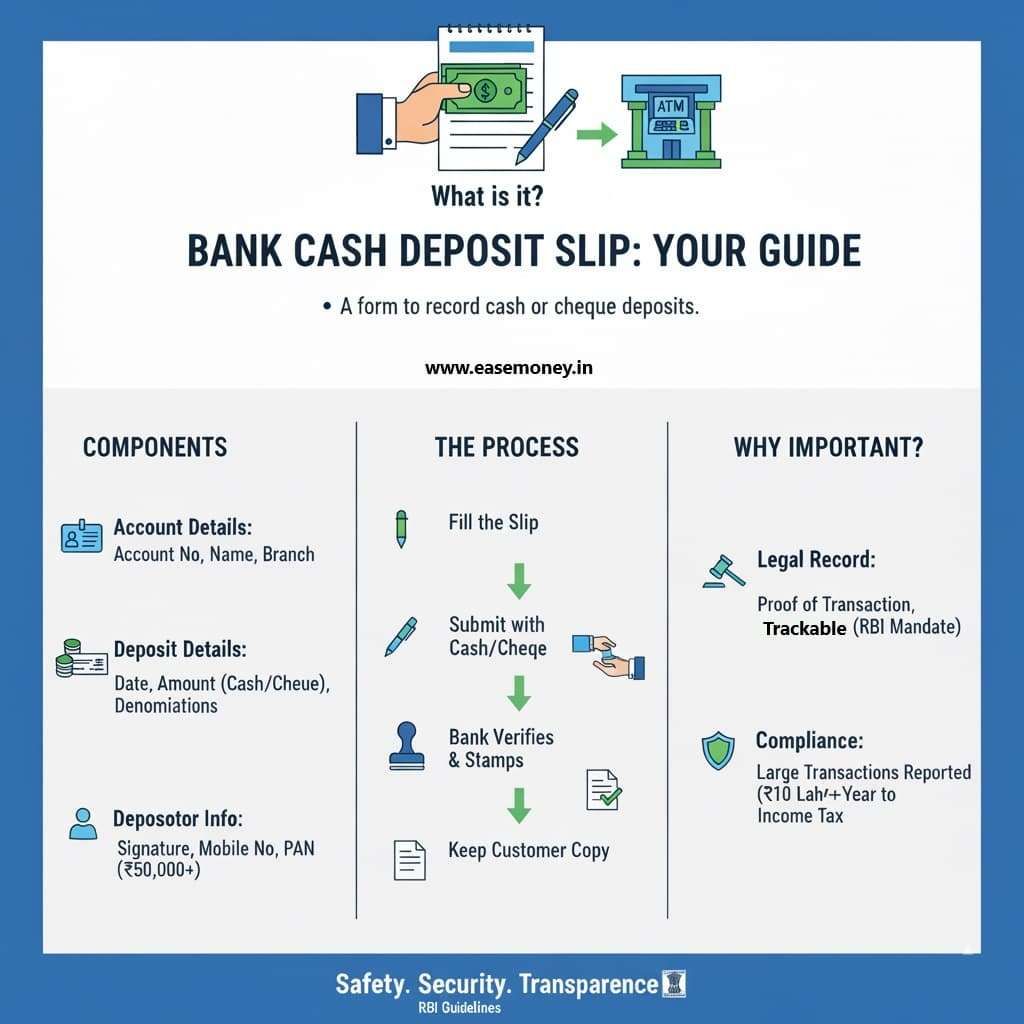

What is a Bank Deposit Slip?

A deposit slip, also known as a pay-in slip, is a small form that you need to fill out when you depositing cash or a cheque into your account via your bank branch. It’s nothing fancy — just a written record that says who deposited money, how much, and in which account.

Banks keep one half of the slip (the bank copy) and return the other half (the customer copy) with a stamp. That stamp is your proof that you’ve actually deposited the money.

According to the Reserve Bank of India (RBI) policies, banks must maintain these records on paper and digitally, but why? Because every cash or cheque transaction must be traceable. For example:

- If you deposit ₹50,000 or more cash at one time, RBI rules say you must write your PAN number on the slip.

- If you deposit a very large amount over a year, such as ₹10 lakh or above, the bank is required to report it to the Income Tax Department.

So the humble deposit slip is actually an important legal document, not just a piece of paper; it works as a first line of documentation to keep the banking secure and recorded.

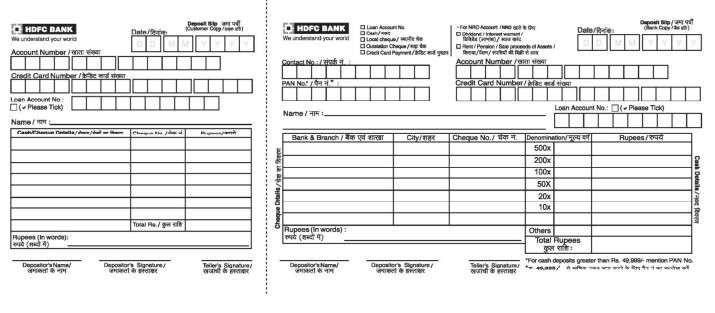

Cash Slip Structure: What It Looks Like

While the look of a slab changes from bank to bank, over 90% of information is usually the same on each slip.

Most of the Private bank slips are double-sided; you have to fill both sides, such as HDFC, Axis, Kotak, or ICICI Bank.

The front side has spaces for:

- Contact Number and account details

Basic Cash denomination table (₹2000, ₹500, etc.). - Cheque details (cheque no., bank, branch, amount).

- Write down your 10-digit PAN number in the boxes.

- Depositor and teller signatures and stamp.

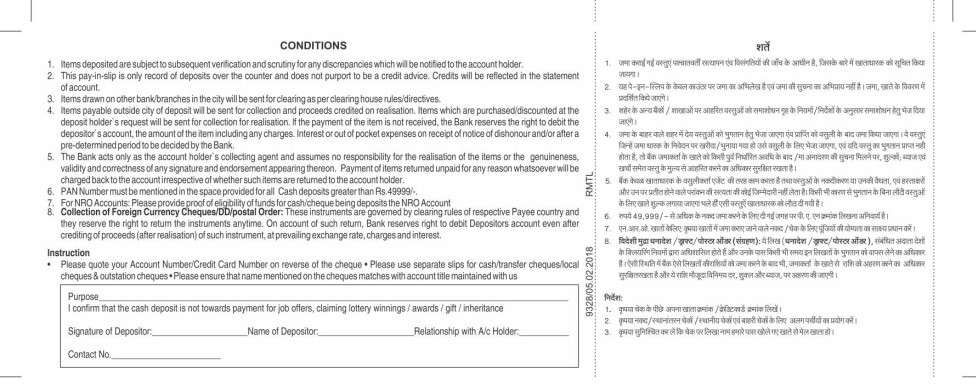

The back side lists conditions and fill-ups, like:

- On the back, they usually ask about your relationship with the account holder.

- What is the purpose of this deposit, such as savings, for paying bills, pocket money or anything?

- Deposits are subject to verification.

- Local vs outstation cheques follow clearing rules.

- The bank acts as a collecting agent, not responsible for dishonoured cheques.

- Separate slips for cash, local cheques, and outstation cheques.

- Depositor must confirm cash is not for job offers/lottery scams.

- Your signature and name.

Filling a Cash-Only Deposit Slip: Step-by-Step Guide

- First, write down your date in the side corner (dd/mm/yyyy).

- Account number – carefully in each box, without errors.

- Name – as per bank records, check your passbook for a double check.

- Mobile number – useful if the bank needs to contact you.

- Cash denomination table –

- ₹2000 × 2 = ₹4000

- ₹500 × 6 = ₹3000

- ₹100 × 10 = ₹1000

- Total = ₹8000

- Use our free Cash Denomination Calculator for pre-ready.

- Amount in words – “Eight Thousand Only.”

- PAN – if depositing above ₹50,000 in cash.

- Signature – depositor signs once or twice. (mostly depends on banks)

- Hand over slip + cash – teller counts, verifies, and stamps your copy.

While filling a pay-in slip for depositing cash, you have to fill few information twice in any bank of india, such as –

- Your Account number

- Account holder Name

- Current date

- Deposit amount in words and digits.

- Your Branch name (if applicable)

- Depositer name (if you are filling for someone else)

Note: Your customer copy works as an Acknowledgement slip; you can use it to track if the amount is delayed.

How to Deposit a Cheque at the Bank Branch

If you have a cheque and want to deposit it at your bank branch, you need to fill up the same bank deposit slip, but this time, you have to ignore the denomination table –

- Date, account number, name, mobile – same as cash slip.

- Cheque table – fill in:

- Cheque number (last 6 digits).

- Bank name and branch.

- City.

- Cheque date.

- Amount.

- If you have multiple cheques, you can use another column for that.

- Amount in words – as written on the cheque.

- Attach cheque – staple/pin to slip.

- Back of cheque – write your account number and sign twice (mandatory for most banks).

- Signature on slip – depositor’s box.

- Hand over slip + cheque – teller stamps customer copy. The cheque is sent for clearing.

Pro tip: You have to write in block letters and use a blue or black pen only. If you make a mistake, don’t overwrite — just take a fresh slip.

Bank-Wise Guides (Master Table)

| Bank | Notes |

|---|---|

| HDFC Bank | Double-sided slip, the back side is also required. Fill both copies. |

| ICICI Bank | Separate slips for cash & cheque. Not all branches accept printed slips. |

| SBI Bank | Simple slip format. Requires branch code. |

| Bank of Baroda (BoB) | It is a regular slip just like HDFC or SBI. work for cheques and deposits. |

| Canara Bank | A bilingual deposit form for all types of accounts. |

| Punjab National Bank (PNB) | A simple and regular Pay-in-slip (deposit slip) similar to other PSU banks. |

| Post Office (Savings Scheme) | A All-in-One deposit slip for different account types |

| Bank of India (BOI) | In metro cities, Bank of India (BOI) branches often provide English-only slips |

What is the Processing Time for Deposits

- Cash deposits – Usually credited instantly in the home branch. In non-home branches, you may find a short delay of upto 30 minutes.

- Local cheques – 1–2 working days.

- Outstation cheques – 3–7 days depending on location.

- High-value cheques (₹2 lakh+) – Same-day credit if submitted before cut-off (usually 1 PM–3 PM).

Before visiting the branch, first clear your branch’s cut-off timings.

Is there any charge for a deposit slip?

Good news — deposit slips are free. Banks don’t charge you for depositing cash or a cheque. The slip itself is part of the banking service of your regular bank account.

Where do you get a deposit slip?

1. At the branch counter or desks

- At the bank branch, you will get a stack of printed deposit slips near the counters or help desk. You can just pick one, fill it, and submit.

- These are the “official” ones most branches prefer because they carry the bank’s print style, space for the teller’s stamp, and sometimes even a printed slip number.

- You can get multiple languages as well, such as Hindi, English, Tamil and more. However, most banks offer bilingual slips.

2. Online (PDF download)

Big public banks (HDFC, ICICI, SBI, Axis, Kotak, etc.) allow you to download deposit slips from their official website.

Open the form centre of the bank site, under Account Services/Deposits, find “Pay-in Slip” or “Deposit Slip,” and download any language you want.

These PDFs can usually be:

- Printed → you fill by hand.

- Fillable → you type details directly on your computer/phone using free editors like Sejda, iLovePDF, or Adobe Acrobat and then print.

But there is a catch – Not every branch accepts a downloaded/printed slip. Many branches insist you use the slips kept at their desks.

Why? Because their printed slips have unique cut-out paper with a stamp or branch internal record-keeping.

Digital Alternatives: Online Slips for the Branch Counter

Most of the Indian Private banks have now started cutting down on paper slips, now the enable the online deposit slip facility, which works across all branches.

No need to fill up by hand. However, it only works for depositing with the account holder; for third parties, you still need a physical slip for declaration and a relationship with the account holder.

For example, in HDFC, ICICI, and Axis Bank, you can generate a pay-in slip through mobile banking or internet banking:

- Log in to your app/net banking.

- Go to Accounts, select deposit, tap on Pay-in slip.

- Enter the account number and amount.

- The bank sends you an SMS with a Reference ID.

- Visit the branch, hand over your cash, and show the SMS at the counter.

- The teller verifies the Reference ID, accepts the cash or cheque leaf, and is done.

- You will get a confirmation SMS on the linked mobile number.

What to Keep in Mind: Common Deposit Slip Mistakes & Tips

| Mistake | What goes wrong / delay | How to avoid |

|---|---|---|

| Wrong account number or misspelled name | Money may go to the wrong account; it requires correction | Double-check before submitting |

| Illegible handwriting | The Bank may reject or ask for slip to be redone | Use block letters, clear pen |

| Forgetting to write in words | Bank cannot accept or may delay | Always write amount in words correctly |

| Not bringing the necessary ID or PAN (if required) | May be refused or delayed | Carry PAN or Form 60 etc. |

| Overwriting or corrections on slip | Banks often reject slips with corrections | Wrong account number or misspelt name |

Add-on Questions For You

Do I always need a deposit slip to put cash in my account, or can the teller accept it directly?

At the branch counter, yes, you usually need a slip. Without it, the teller has no record. At a CDM (Cash Deposit Machine), no slip is required — your card/account number is the record.

Are deposit slips and withdrawal slips the same in the Bank?

No, they are completely different. A deposit slip = add money. Withdrawal slip = take money. Design is similar, but withdrawal slips usually ask for signature verification and sometimes require a passbook.

Is a deposit slip mandatory for every bank cash deposit?

Yes, at branch counters, deposit slips are mandatory. Banks need written transaction details for audit and compliance, as required under Reserve Bank of India guidelines.

Can someone else deposit cash into my account using a deposit slip?

Yes, third-party deposits are allowed. The depositor must correctly fill account details, sign the slip, and sometimes mention their relationship with the account holder.

What happens if I write the wrong amount on a deposit slip?

Banks may reject the slip or ask you to refill it. If accepted wrongly, correction takes time and requires branch verification, so accuracy is very important.

Is PAN required for cheque deposits also?

Usually no. PAN is mainly required for large cash deposits. Cheque deposits follow clearing rules and identity verification is already linked to the account.

Can I reuse an old deposit slip photocopy?

No. Banks generally reject reused or photocopied slips. Fresh slips are preferred because they include branch codes, tracking details, and teller stamping sections.

Why do banks ask the purpose of cash deposits on slips?

Banks collect purpose details for monitoring suspicious transactions, fraud prevention, and regulatory reporting. It helps them flag unusual activity patterns in accounts.

Does a deposit slip work the same for joint accounts?

Yes. The deposit slip format is the same, but the account number must match the joint account. Any person can deposit; signatures are not verified for deposits.

Is cash deposited through slip reflected immediately in passbook?

Usually yes for home branch deposits. However, during peak hours or system delays, passbook updates may reflect after a short processing time.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.