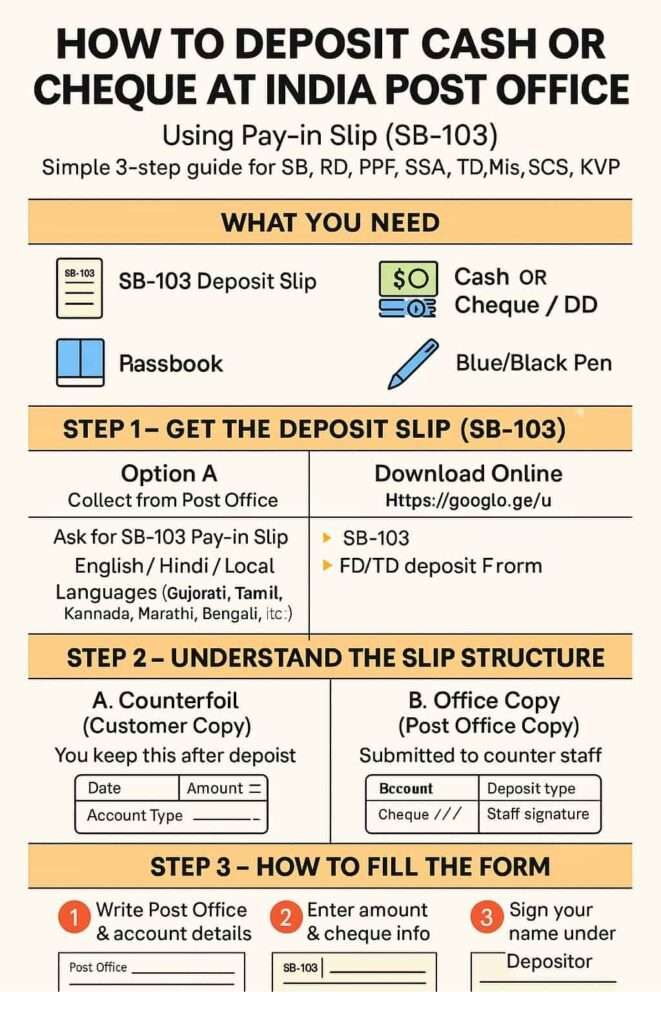

What You Can Do With the Post Office Deposit Slip

The Post Office Deposit Form, also known as the Pay-in Slip (SB-103), is a straightforward English/Hindi form used to deposit money into various India Post small savings accounts. With this single slip, you can deposit cash, cheque, or DD into schemes like SB, RD, PPF, SSA, TD, MIS, SCSS, NSC, and KVP.

Unlike many bank forms, this single-page slip remains the same across India. A few years back, it had multiple formats, but now most post offices have a single format for all. It is available in English, Hindi, and sometimes your local language (depending on your city location; for example, South India may have a different language slip).

Supported Account Types with full form

| Account Type | Full Name | What You Can Do With the SB-103 Form |

|---|---|---|

| SB | Savings Account | Deposit cash/cheque/DD |

| RD | Recurring Deposit | Deposit the monthly instalment/advance deposit/ clear the default |

| TD | Time Deposit | Open or deposit into 1/2/3/5 year FD |

| MIS | Monthly Income Scheme | Deposit capital amount |

| SCSS | Senior Citizen Savings Scheme | Deposit quarterly or opening amount |

| PPF | Public Provident Fund | Yearly deposit/default payment/loan repayment |

| SSA | Sukanya Samriddhi Account | Monthly/yearly deposits or default payments |

| KVP | Kisan Vikas Patra | Purchase certificates |

| NSC | National Savings Certificate | Buy NSCs through a deposit |

This is the only slip you need for deposits across India Post’s small savings network.

How to Use the Post Office Deposit Form for Cash or Cheque

1 Step: Get or Download the Form

You can collect the SB-103 form in two simple ways:

Option A: Get It from Your Post Office

- Visit any City/H.O/S.O/B.O (Post office Scheme CBS) near you OR you can visit Locate the Nearest Post Office.

- Ask for Pay-in Slip SB-103 or collect it from the nearby cash counter desk.

- Request the language you prefer:

- English

- Hindi

- Local language (Gujarati, Tamil, Kannada, Bengali, etc.)

Tip: All metro (north cities) Branch post offices may have forms only in English/Hindi.

Option B: Download the Form Digitally

| Form Type | Language | Download Link |

|---|---|---|

| Post Office Deposit Form (SB-103) ((scroll down – it contains a withdrawal form as well)) | English | PDF Original Link |

| Post Office FD/TD Deposit Form | English | Post Office Fixed Deposit Form PDF original |

Download, print, and carry this form when visiting the post office.

2 Step: How to Fill Up the Deposit Form

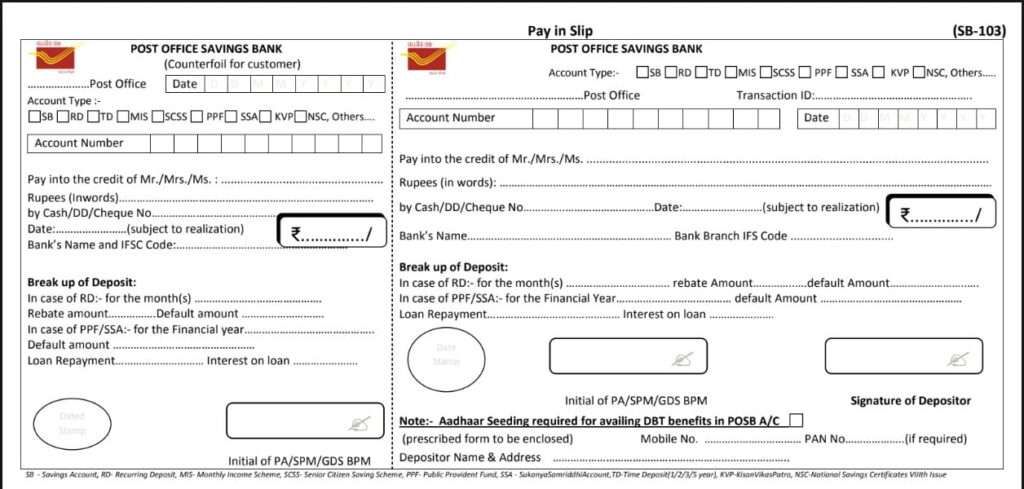

The form has two sides:

- Side A – Counterfoil (Customer Copy)

- Side B – Post Office Copy

Both sides ask for similar details. You fill both, the postal staff stamps both, and you keep the counterfoil.

Side A: Counterfoil (Your Copy) – How to Fill

| Field | What to Fill | Example | Tips |

|---|---|---|---|

| Post Office | Your branch name | Rajkot Head Post Office | Match what is printed on passbook |

| Account Type | Tick one | SB | Never tick two schemes |

| Name | Account holder name | Nanne Parmar | As per your passbook |

| Amount (Words) | Deposit amount in words | Rupees Two Thousand Only | Must match digits |

| Cash/DD/Cheque No | Payment mode | Cash | If cheque, write 6-digit number |

| Bank Name/IFSC | Only for cheque/DD | SBI, SBIN0000456 | Ignore for cash |

| Date | Today’s date | 19/11/2026 | Use DD-MM-YYYY |

| Deposit Break-up | Only if you deposit RD/PPF/SSA | RD for Oct–Dec | Ignore if SB deposit or Cash or cheque |

| Signature | Your signature | — | Match your account signature |

Postal staff will sign/stamp the bottom part. Keep this copy safe.

Side B: Post Office Copy – How to Fill

This copy stays with the postal clerk, so it has a few additional fields:

| Field | What to Fill | Example |

|---|---|---|

| Transaction ID | Leave blank (staff fills) | — |

| Account Number | Your 10 to 12 digits account number | 1234567890 |

| Amount (Words) | Same as Side A | Rupees Two Thousand Only |

| Cheque/DD/Cash | Tick one | Cash |

| Bank Name & IFSC | Only if using cheque/DD | SBI – SBIN0000456 |

| Depositor Info | Full name & address | Nanne Parmar, Rajkot |

| Mobile/PAN | As needed | PAN for deposits above ₹50,000 |

Tips for Filling

- Always use capital letters and a Blue or Black Pen.

- Keep the amount clearly written.

- Don’t overwrite; use a fresh form if needed.

- For cheque deposits, attach the cheque to the slip using a pin.

- Don’t write in “Initial of PA/SPM/GDS BPM”—that’s for staff only.

3 Step – How to Submit the Form at the Post Office

- Fill both sides neatly.

- Attach cash/cheque/DD with the form.

- Go to the deposit counter.

- The clerk will verify your amount, signature, and account.

- They will stamp:

- Your Counterfoil

- Their office copy

- You collect the stamped customer counterfoil as proof.

- Deposit is processed instantly for cash; cheque/DD takes clearing time.

What are the Limits & Processing Time

Cash Deposit Limit (Very Important)

- Branch Post Office Cash Deposit Limit: ₹50,000 per account per day

- No limit for cash deposits at Head Office or Larger Sub Offices

- Unlimited deposits allowed via cheque or DD

Cheque/DD Deposit Limits

You can deposit any amount via cheque/DD into:

- SB

- RD

- TD

- MIS

- SCSS

- PPF

- SSA

- NSC

- KVP

Earlier, non-home branch deposits had restrictions (₹25,000), but now all CBS-enabled post offices accept unlimited cheque deposits.

Income Tax Reporting

- Cheque/cash deposits of ₹10 lakh and above in a year are reported to the Income Tax Department.

- Keep proof of fund source ready (salary slip, business records, bank statement, etc.).

Processing Time Based on Mode

| Payment Type | Processing Time | Notes |

|---|---|---|

| Cash | Instant | Balance reflects the same day |

| Cheque | 1 working day | if no holiday, and the cut-off timing is balanced |

| DD (Demand Draft) | 1–2 days | Depends on the issuing bank |

| Default/Loan Payments (PPF/SSA) | Same day | Reflected by evening or the next morning |

FAQs Archive

What happens if I make a small mistake while filling out the India Post office slip?

Small spelling errors are fine, but incorrect account numbers or amounts aren’t accepted. It’s better to take a fresh slip from the counter and rewrite cleanly.

Can someone else deposit money in my Post Office account using this slip?

Yes, anyone can deposit on your behalf. They just need your account number and name. Signature is required only for the depositor section, not the account holder.

Can I use one SB-103 slip to deposit into two different accounts?

No. One slip supports only one account at a time. If you have an SB and RD deposit, you must fill two separate slips for smooth processing.

Can I use one SB-103 deposit slip for different schemes together?

No. One SB-103 slip supports only one scheme and one account. If you’re depositing into SB and RD together, use two separate slips to avoid rejection at the counter.

Is the SB-103 deposit form valid at any post office in India?

Yes, as long as the post office is CBS-enabled. Almost all Head Offices and major Sub Offices accept it nationwide. Only very small Branch Offices may have local handling limits.

What’s the safest way to write the amount to avoid rejection?

Always write the amount in clear capital letters, matching digits exactly. If words and numbers differ, the clerk rejects the slip instantly and asks for a fresh form.

Can I deposit cash into someone else’s post office account using SB-103?

Yes. Anyone can deposit cash using SB-103 with the correct account number and name. No authorisation letter is needed. Signature is of the depositor, not the account holder.

How long should I keep the SB-103 counterfoil safely?

Keep it until the amount reflects plus at least 3 working days. For cheque or DD deposits, retain it until clearance completes—it’s your only proof if entries mismatch.

What’s the best time to deposit a cheque or a DD at the post office?

Deposit before 2 PM on working days. Early submission improves same-day or next-day processing. Late deposits may roll over due to clearing cut-off timings.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.