What is Customer ID in Banking?

The Customer ID is a special number created and assigned to you by the bank. It is a system-generated digit for each user of the bank for accessing the banking facility. It must be required in NetBanking and mobile banking registration for the online account.

Think of it like your bank-specific identity number. Every time you open an account, your bank ties it to your Customer ID. Even if you have multiple accounts — savings, current, or fixed deposit — they are all linked under one Customer ID.

Here is a quick example for you –

Suppose you opened a savings account in the HDFC Bank in 2015. Your passbook may show a 9-digit Customer ID. Later, you get a credit card from HDFC. That Credit card is also mapped to your same Customer ID.

When you install the HDFC mobile app, it asks for your Customer ID to access your bank account and your credit card account.

How to Find Your Customer ID (All Banks)

Here is the list of bank guides with methods to retrieve your Customer ID. We researched and found the easiest options provided by the bank for users, check it out –

| # | Bank Name | Guide links |

|---|---|---|

| 1 | India Post Payments Bank | Find IPPB Customer ID |

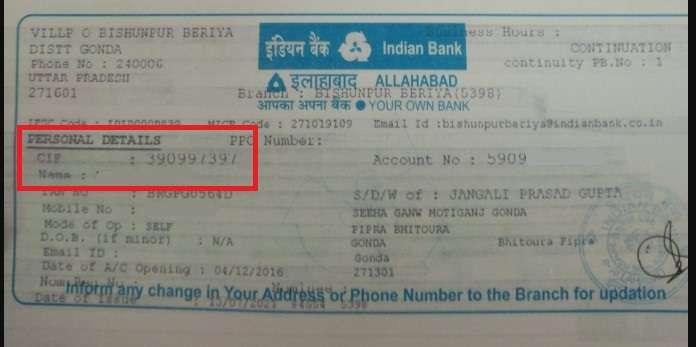

| 2 | Indian Bank | Find Indian Bank CIF |

| 3 | IDBI Bank | Find IDBI Customer ID |

| 4 | Central Bank of India | Find Central Bank CIF |

| 5 | Saraswat Bank | Find the Saraswat Customer ID |

| 6 | Punjab National Bank | Find PNB Customer ID |

| 7 | Yes Bank | Find the Yes Bank Customer ID |

| 8 | Canara Bank | Find Canara Bank Customer ID |

| 9 | Bandhan Bank | Find Bandhan Bank Customer ID |

| 10 | Karur Vysya Bank | Find KVB Customer ID |

| 11 | Kotak Mahindra Bank | Find Kotak CRN |

| 12 | HDFC Bank | Retrieve in 3 Steps |

| 13 | Union Bank of India | Get ID using multiple methods |

| 14 | Karnataka Bank | Explore here |

| 15 | Indian Overseas Bank | Cust ID options |

| 16 | Axis Bank | Find methods here |

| 17 | Bank of Baroda | SMS method |

| 18 | State Bank of India (SBI) | Customer Care and SMS |

Note: This list adds more banks regularly

Retrieve your CIF ID (Works on all banks in India)

If you don’t want to go online, here is the list of options that work with almost every bank in india. It is fast, and no internet is required.

- Bank Passbook – When you open an account, the bank posts a passbook to your doorstep. Simply open the first page and view your CIF or customer ID.

- Welcome Kit – It is received shortly after KYC, typically delivered via mail. Check it out, the papers.

- Welcome Letter – If you open a bank account, they will send a letter via post and email.

- Bank Statement (PDF or printed) – Top section, sometimes near IFSC.

- QR Card – Most banks, like India Post, now provide a QR Card rather than a Passbook. Flip it to find your CIF ID.

- ATM Slip – It still works for some banks, try it out.

- ATM and Debit Card – Simply flip your card; most banks offer CRN printed, such as Kotak Mahindra Bank.

- Call Customer Care – With account verification

- Visit the Branch – With ID proof for verification

How to Find Customer ID Using Net Banking

- Log in to your net banking account using your username and password.

- Go to your account profile or account details section.

- Look for Customer ID / Customer Number – it’s usually listed along with account number and branch details.

- Download the account statement or e-passbook from the portal – Customer ID is often mentioned there.

- If you can’t find it, use the help/support section in net banking or chat with customer care online.

Customer IDs: Different Names

Customer IDs have multiple names, which depend on the bank. Here are the other names with full form –

- CIF (Customer Information File) – e.g., SBI, Indian Bank, Central Bank of India.

- CN (Customer Number) – Mostly Gramin banks

- CRN (Customer Relationship Number) – e.g., Kotak Bank

- CIN (Customer Identification Number) – e.g., Bandhan Bank

- User ID – often generated from or based on Customer ID, it is the same as Cust ID. For example, Punjab National Bank.

- Login ID – used for internet/mobile banking

Why do banks provide it?

Banks usually have millions of customers, even in rural banks. So, managing each individual by their account number alone would be chaotic and challenging. That’s why banks first assign a number so they know everything about you from a single ID. named as CIF or customer ID.

It helps banks to manage –

- Handle customer relationships across products

- Allows services like pre-approved offers, faster KYC, and notifications across products like credit cards or loans.

- Secures digital access across mobile/net banking

- Easier to operate internal operations and regulatory compliance

What are the Components?

While it may look like a random string or number, it’s linked to:

- Your account(s)

- Mobile number and email ID

- PAN or Aadhaar (if provided)

- Past transactions

- Linked products (credit cards, loans, insurance)

The format of the Customer ID or CIF

To understand the pattern in the example, PNB uses a format like AGY002525 as your CIF Number — a mix of letters and numbers. On the other hand, HDFC uses only a 9-digit number. The format depends on the bank, but the purpose remains the same: all your banking activities under one roof.

Where is the CIF Number Or ID Required?

You will need your Customer ID in many everyday banking situations:

- Registering for mobile or net banking

- Logging into banking apps

- Linking your account to third-party apps like Cred or PhonePe

- Getting e-statements or passbook updates

- Accessing your monthly e-statement via email.

- Lodging complaints via email, customer care, and the support page of their website.

- tracking service requests

- It is required to access a pre-approved loan or credit card offer

- For credit card holders, it is required to activate and register your credit card with the bank.

How Customer ID Works for Credit Cards

In some banks, especially private banks like HDFC, AXIS, and ICICI:

- The same Customer ID is used across both savings accounts and credit cards

- It helps banks assess your creditworthiness and profile value.

- Your credit card bill, loan eligibility, and offers are personalised based on this ID

For example, if you have an Axis savings account and later get an Axis credit card, both are often organised under the same Customer Number.

Difference Between Customer ID and Account Number

| Feature | Customer ID | Account Number |

|---|---|---|

| Purpose | Identify yourself as a customer | Identify a specific account |

| Unique Per Person | Yes | No (you may have many accounts) |

| Used For Login | Yes (in most banks) | Sometimes |

| Changes Over Time | Rarely | Yes (if you open/close accounts) |

More questions

What if my passbook doesn’t show the Customer ID?

As per RBI Regulations, all banks need to print a Customer ID on the physical and digital passbook. In case, not printed, visit your home branch and update your passbook and ask for the Customer ID or CIF to be printed.

Is Customer ID the same as CIF, CRN, or User ID?

Yes, it depends on the bank-to-bank. such as SBI uses CIF, Kotak uses CRN, others say Customer ID. It all refers to the same thing.

Can I generate a Customer ID online if I have lost it?

You can not generate a Customer ID; however, you can retrieve it. Some banks offer online retrieval using your account number and mobile number. Otherwise, contact customer support or visit a branch.

Does Net Banking User ID mean Customer ID?

Not always. In some banks, the User ID is created based on your Customer ID. In others, it’s different and set during registration. It is also known as a Login ID, which you can create manually for safety.

Can two people have the same Customer ID in a bank?

No. A Customer ID is unique to one individual. Even joint account holders have separate Customer IDs, though the same account number may appear under both profiles.

Does Customer ID change if I change my mobile number or address?

No. Updating mobile number or address does not change your Customer ID. It remains permanent unless the bank officially merges or closes your entire customer profile.

Is the Customer ID printed on cheques or cheque books?

Usually no. Cheques display the account number and IFSC only. Customer ID is mainly used for digital access, internal banking records, and service verification.

Can I share my Customer ID safely with others?

It’s safer not to. While Customer ID alone can’t move money, sharing it may increase phishing or social-engineering risks when combined with other personal details.

What happens to my Customer ID if I close all bank accounts?

Banks usually retain the Customer ID internally for records and compliance. It becomes inactive, but may reactivate if you open a new account later.

Is Customer ID required for cash deposits or withdrawals at branch?

No. For branch cash transactions, account number and identity proof are enough. Customer ID is mainly required for digital banking and service requests.

Is Customer ID governed by any banking regulation in India?

Yes. Banks maintain Customer IDs under KYC and record-keeping norms issued by the Reserve Bank of India to ensure traceability and customer identification.

Why do banks ask Customer ID during complaint registration?

Customer ID helps banks quickly fetch your full profile, linked products, and history, allowing faster resolution and accurate tracking as per regulatory guidelines.

Last Update by 16/01/2026 and Reviewed By Nanne Parmar