Your IDBI Customer ID (also called CIF Number) is a unique 8-digit numeric special code generated by the bank when you open an account. It is not like your account number, but it is linked to your banking profile.

IDBI Bank is one of the oldest commercial banks in India, founded in 1964. According to the data from IDBI Wikipedia Page, the bank’s touch revenue of ₹30,370 crore (US$3.6 billion) till 2024 and total customer base of around 2.24 million.

To handle these millions of customers easily and securely, the bank assigns a unique Customer Special ID to every account holder.

Now, in future, if you apply for a loan or credit card, a new savings account, FD with them, the ID will remain single.

Fun fact – Even if you close and reopen your account later, your Customer ID usually remains the same—it’s your banking identity.

Why Doesn’t IDBI Offer SMS or Self-Service to Get a Customer ID?

Unlike some modern private banks, IDBI has limited digital options. There’s no direct SMS shortcode, CIF by missed call, or online self-service to recover your Customer ID.

This is likely due to a focus on security and legacy systems. However, the bank is working to provide more digital services soon. But yes, this is frustrating, but you still have options. Even If You Forgot It or lost your IDBI Bank documents.

Now let’s walk through the actual, working ways to retrieve your IDBI CIF or Customer ID if you have lost it or don’t know where to look.

Update in 2026 – IDBI NetBanking fully depends on your Customer ID (CIF) for registration, login recovery, and digital services. Even after shifting to the new idbi.bank.in portal after the RBI’s new policy, the bank has not provided any direct “find or recover Customer ID” option. Without CIF, online onboarding is impossible, forcing customers to rely on branches or customer care.

Real Problem: Where to locate the Customer ID, Just After Opening an IDBI Account

If you opened your account just a few days back, and the passbook and Login Details have still not been delivered to you. However, you will need your ID for NetBanking and to use other digital products. Here are the real working preferences you only have –

- Go to your home branch (or any nearby IDBI Bank branch).

- Carry a valid photo ID proof like Aadhaar or PAN.

- Ask the staff to help retrieve your Customer ID.

- After verification, they will give it to you immediately.

This is the most foolproof way, especially if you don’t have digital access or have lost your documents.

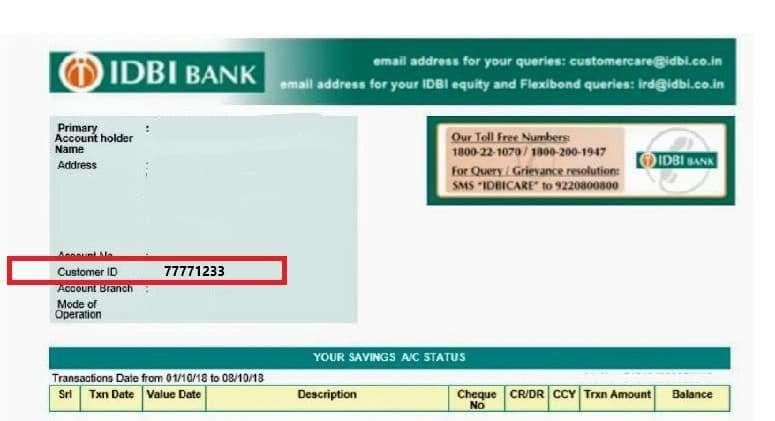

1. Find your CIF ID in your IDBI Passbook

When you applied for an account in IDBI, the bank sent a physical passbook to your doorstep. It is one of the easiest ways to recover your ID.

- Look at the first page. where your photo is attached.

- Find a printed as a “CUST ID” or “CIF No.” usually just below your full name and Date of birth.

- It will be an 8-digit number, different from your account number.

Tip – You can take a photo of your passbook on your phone and keep it checked whenever required, but keep it private.

Note: if not printed, visit your IDBI home branch and request a new passbook with a printed CIF.

2. Look Inside Your Welcome Kit

After successful KYC, the IDBI sent a full document file, also known as the Welcome kit, to your registered residential address. This kit includes your ATM PIN, cheque book, and sometimes a summary sheet. Check a few documents, such as –

- Welcome Letter: When you open a new account with IDBI Bank, the bank gives a welcome letter that often contains important details, including your Customer ID. Find your welcome letter in your email, too.

- Cheque book: Open the first page or the cheque stub. Look in the top section, where your name and account number are printed. Often, the Customer ID is also printed there. The Customer ID on the cheque book has very limited facilities.

- Old Bank Statement: If you have applied for a physical monthly account statement that is received on your doorstep, check the header just below your account number to find it. With the IDBI mobile banking app, you can request a physical statement.

Where can I find my IDBI Credit card Customer ID?

If you are looking for the Customer ID of your Credit card, and do not have an active deposit account in IDBI, then please check your credit card attached paper, it is mentioned just below your name and credit limit.

- Most banks also print CIF on the back of the card. (optional)

3. Get ID by IDBI Customer Care Support

This can be a practical option to choose; you can simply call their customer care and ask for your customer ID directly. The bank needs to verify you first. Please cooperate with them.

To the savings account Customer ID

For account-related queries, it’s important to contact IDBI Bank’s dedicated helpline numbers:

- Toll-Free: 1800-209-4324 or 1800-22-1070 (24×7 service)

- Non-Toll-Free: +91-22-67719100 (within India and outside India)

- Email: customercare@idbi.co.in

For IDBI Credit Card Customer Number

If you need your Customer ID for an IDBI Bank credit card, customer care is a reliable option. Follow these steps to get it:

- Toll-Free (24×7): 1800 425 7600

- Non-Toll-Free: 022 – 4042 6013 (charges apply)

- You can email at idbicards@idbi.co.in

4. Use IDBI Digital Services

1. Internet banking (Only if Registered)

If you have already registered with IDBI and have a login ID and password, you can then access your customer ID. Follow the steps –

- First, visit the official IDBI website and select the Internet banking option.

- Sign in using your Login ID and Password and navigate to the dashboard.

- On the dashboard, tap on Account summary and go to my profile, and select Account summary.

- View your ID. If not there, please download the e-statement and view your customer ID at the top of it.

2. IDBI Mobile Banking

Just like IDBI netbanking, just logged in to IDBI Go Mobile+ using 4-digit mpin:

- Tap on Menu > My Profile / Account Information

- Your Customer ID should be displayed there

Message: If you are not registered yet, you won’t be able to use this option—you need the Customer ID to register by default! However, you can move to the next option.

Why and where does your ID matter so much?

Your Customer ID is like the Aadhaar number of your banking life at IDBI. Here are some key services where it is mandatory:

- Registering for Internet Banking

- Activating Mobile Banking

- Resetting your net banking password

- Downloading e-statements

- Activating SMS Banking (requires Customer ID + PIN)

- Contacting customer service for account-related queries

- Linking accounts or applying for new banking services

- Opening recurring deposits or term deposits online

In short: No Customer ID, no digital banking.

Important Q/A

I can’t find it in my IDBI Bank documents—what should I do?

The final option for you is, take your ATM Card, PAN Card, and other ID proof and visit your nearest IDBI branch.

How can I find my IDBI Bank Customer ID by SMS?

Still now, IDBI Bank does not offer any direct SMS method or online option to retrieve your Customer ID.

After IDBI shifted to idbi.bank.in, can I find my Customer ID on the new netbanking portal?

No. Even after IDBI migrated to the new idbi.bank.in netbanking portal, there is still no direct “Find or Forgot Customer ID” option. CIF is visible only after login, not before registration.

Where is the Customer ID mandatory in daily banking with IDBI?

It’s required for netbanking registration, mobile app activation, password reset, e-statements, SMS banking, support calls, and applying for deposits or loans. Without CIF, digital banking simply stops.

Is customer care a safe way to get my IDBI Customer ID?

Yes, if you call official helplines. After identity checks like DOB and account digits, executives usually share the Customer ID verbally. Keep pen and paper ready during the call.

I just opened an IDBI account and haven’t received documents. What should I do?

Visit your home or nearest branch with Aadhaar or PAN. Staff can instantly retrieve and tell your Customer ID after verification. This is the fastest and most reliable method.

Why doesn’t IDBI allow Customer ID retrieval via SMS or missed call?

From branch experience, IDBI avoids SMS-based CIF recovery due to legacy systems and security concerns. Even after moving to the new netbanking portal, self-recovery options are still unavailable.

Can I find my IDBI Customer ID in the welcome kit or cheque book?

Yes. The welcome letter often mentions it. In many cheque books, the CIF is printed near your name on the first page or cheque stub, though with limited usability.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.