About the Bank: How MGB Was Formed

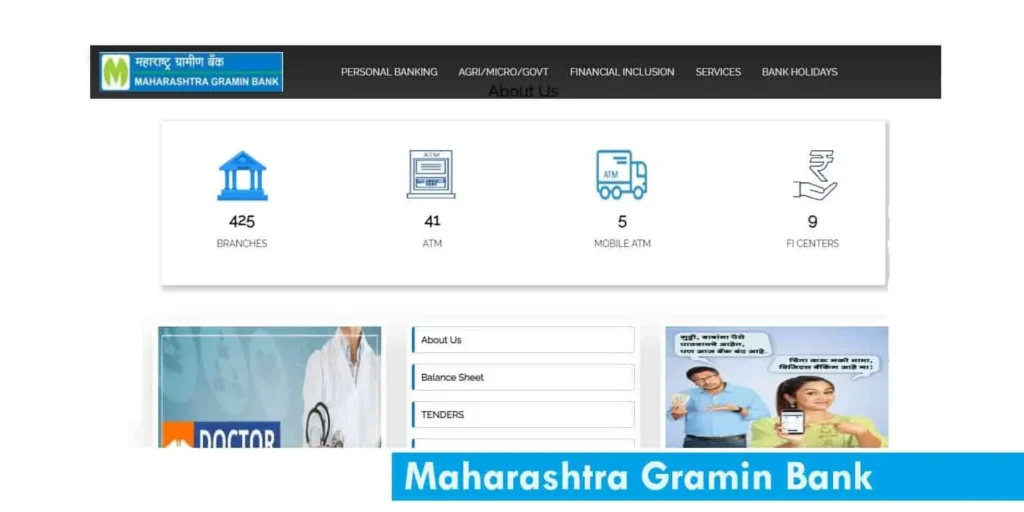

Maharashtra Gramin Bank was launched on 20 July 2009. It is owned by the Indian government, the Government of Maharashtra, and Maha Bank.

The Bank primarily focuses on rural economic growth. It gives loans to farmers, students, people who want to build homes, and small businesses.

What Story of the merger

The Maharashtra Gramin Bank was formed by the merging of multiple rural banks in Maharashtra –

- Aurangabad Jalna Gramin Bank + Thane Gramin Bank = Maharashtra Godavari Gramin Bank (Date: 25/03/2008)

- Maharashtra Godavari Gramin Bank + Marathawada Gramin Bank = Maharashtra Gramin Bank (Date:20/07/2009)

If your account was with one of the merged banks, your account was automatically transferred to Maharashtra Gramin Bank. You can easily get the balance of your merged account using the same services provided by MGB.

Back to the methods, let’s check out the first and easiest method –

What are the Most Popular options to check the Balance offered by MGB

1. MGB Missed Call Banking Number

According to the announcement section of the official website of Maharashtra Gramin Bank, the bank recently started the service of balance enquiry missed call number 7834888867 for their account holders.

This is among the easiest methods available to choose from. For the Phone banking facility, you will require a mobile phone, your mobile number, which is linked to your MGB account, and an active recharge plan.

Follow the steps:

- Go to the dialer of your phone.

- Enter the balance checking number.

- Dial using the registered SIM.

- The call will disconnect within seconds.

- After a while, you will receive an SMS with your available account balance and the last 4 digits of your bank account number.

- If you are not receiving an SMS, please try again after a few hours.

If still not received after 24 hours, make sure your SMS alerts are activated. If not, please visit your home branch to submit your details and update your mobile number to activate the SMS alerts facility and start receiving messages from the bank.

What Are the Basic Services to Get a Balance?

You can ask for balance details via the customer care helpline is 0240-2590050. (Monday to Friday) You can call after 10 AM for a fast response.

- It is best for those who have just opened their account with the MGB.

- If your missed call banking failed, you can choose this option.

How to Get Maha Gramin Bank Balance using my Smartphone

1. BHIM UPI App

The Maha Gramin Bank is listed as an NPCI Live UPI member along with more than 500 banks. That means it allows bank customers to perform UPI transactions and check balances by using any UPI Apps like BHIM, Google Pay, Phonepe, and PayTM.

All you need, A smartphone, a registered mobile number, a preferred UPI App, and an internet connection.

To check the balance of your MGB bank account by using the BHIM App, follow these steps –

- Download and Install: First, you need to visit the app store and install the BHIM App.

- Set Up The App: Now, you have to create an account by entering your mobile number and verifying via OTP.

- Link your bank account: Go to Add new bank account, and choose Maharashtra Gramin Bank from the list of banks. The bank automatically fetches your account details. To create a UPI PIN, you have to enter your debit card details like number, CVV, Expiry, ATM PIN, and OTP.

- Check Balance: All Set. Simply go to the check balance in the menu, select a bank, enter your UPI PIN, and view your balance.

2. RuPay Debit card

The MGB Bank offers three RuPay ATM Cards – EMV Debit Card, PMJDY Debit Card, and Platinum Debit Card. This can be a great choice for checking balances. RuPay cards are accepted by over 1.9 million ATMs in india.

Here are the steps that you can take to check your balance:

- Find an ATM: First, locate a Maharashtra Gramin Bank ATM near you. Furthermore, you can use the NPCI ATM Locator. (Using an MGB ATM may help you avoid extra fees)

- Insert Your Card: Insert your MGB RuPay Debit card into the ATM slot.

- Enter Your PIN: Now, you have to enter your 4-digit ATM PIN.

- Select a Transaction: The ATM will display a menu with various options. Choose the “Balance Enquiry” option.

- View Your Balance: You will see your available balance on the screen. You can also print a receipt if needed.

- Other Services:

- Mini Statement: Choose “Mini Statement” to view your last five transaction details.

- Complete Your Transaction: Once done, remove your card and take any printed receipts. If you’re finished, select “Cancel” to exit the ATM.

3. MGB Mobile Banking

MGB Mobile Banking is part of their digital banking services. You can download the app and check your balance online. However, you need to register first to start getting the benefit of this feature.

For now, to activate the mobile banking facility, you need to visit your MGB home branch first. You have to contact the bank staff and ask for the internet banking and mobile banking application form. Fill out your personal and banking details on the form and submit it.

The bank will take 24 hours to activate the Mobile banking facility. Once it is done, follow these steps to view the balance using the MGB mBanking App.

- First, download the “MGB Mobile Banking” app from the App Store.

- Open the app and tap on the continue button to verify your mobile number by sending an SMS.

- Now, you have to enter the details like Account number, Captcha, OTP, and tap on Register.

- Here, you have to create a 6-digit MPIN to log in.

- After the Mpin is successfully created, open the app again, enter mpin, and view the balance on the dashboard of the app.

Tips: When you visit your home branch for MGB mobile banking activation, please also request a form for internet banking activation. By using MGB internet banking, you can access your account online anywhere in the world, just using a smartphone or laptop.

Note: Please never share your MPIN, OTP, User ID, or password with anyone, even with MGB bank staff. Also, never use public WiFi for Netbanking.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.